Outline

The Covid-19 pandemic represents an unprecedented economic shock, insofar as it cumulates the effect of both a demand and a supply shock on the aggregate economy, as well as an unprecedented increase in trading costs. In response to this shock, global trade has declined by approximately 30% in the course of the first six months of 2020, but the subsequent rebound of trade volumes during the summer suggests a quick recovery of international exchanges. A detailed analysis of the times series across countries and sectors reveals the magnifying effects of sanitary measures and export restrictions on the effect of the pandemic on global trade. The absence of a significant decline in trade of essential goods and in particular of medical goods is nonetheless cause for optimism, as it illustrates the resilience of global trade relations.

The Covid-19 pandemic has affected the world economy across many dimensions, with fears that the repercussions of this shock will change the global economic landscape permanently. The particularity of the pandemic lies in the fact that it cumulates the effect of both a demand and a supply shock on the aggregate economy, as well as an unprecedented increase in trading costs.

The strong decline in aggregate demand since January 2020 can be attributed to disruptions of consumption patterns due to staggering increases in the number of cases, the increased uncertainty leading to a decrease in labor demand pushing individuals out of the labor force, and the decline in consumption brought about by sanitary restrictions on individuals’ mobility and mass lockdown measures. Parallel to a decline in demand, supply of intermediate inputs and services has been negatively affected by the increase in factory closures and strong restrictions on free mobility across countries. Finally, international trade of goods became costlier in light of reduced air traffic and rising exports restrictions for fear of a shortage of essential goods, in a political context of global trade relations already tensed.

In this series we provide some statistics of global trade patterns between August 2019 and August 2020 to describe the dynamics of global trade in times of coronavirus.

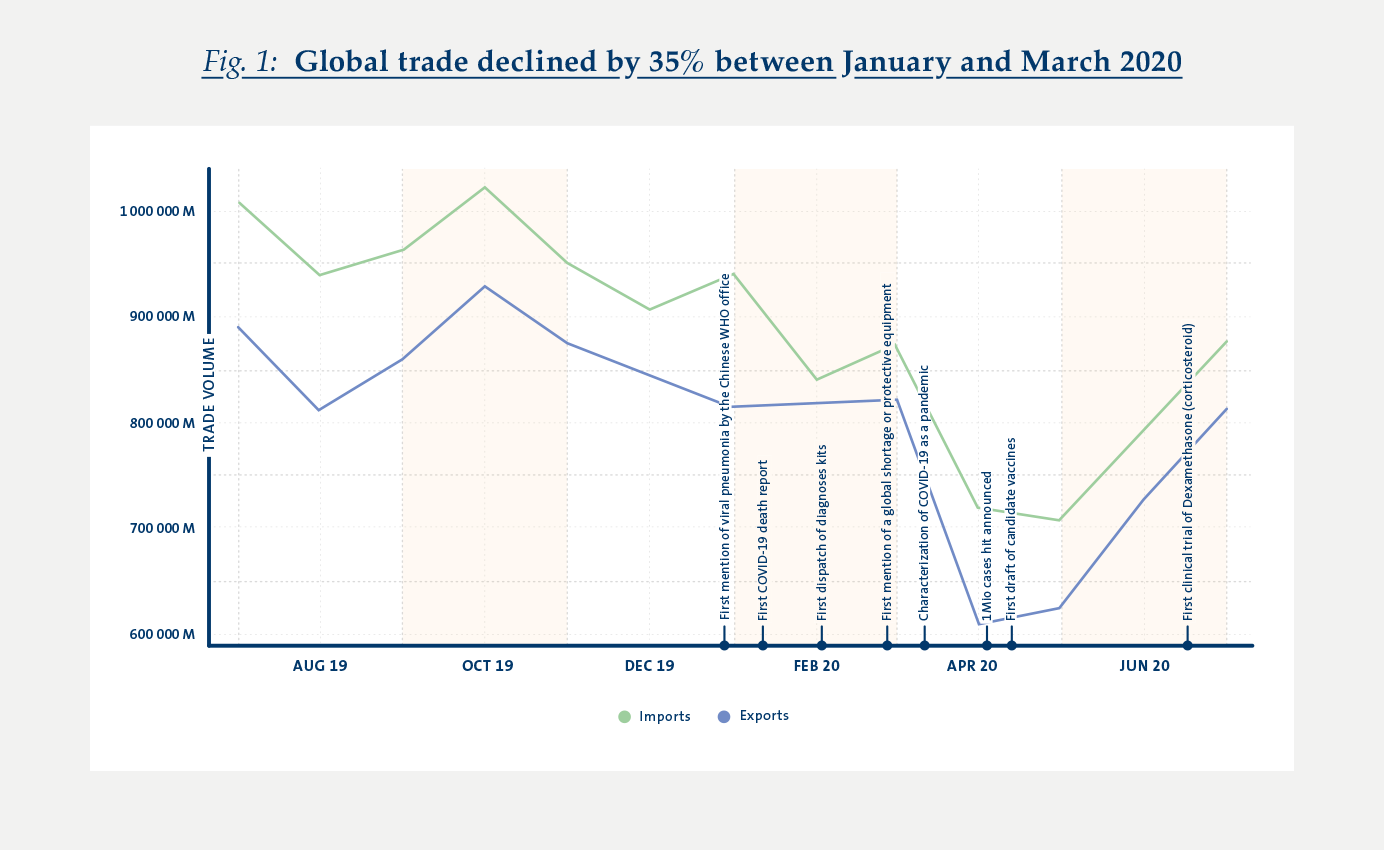

Between January 2020 (when the Chinese WHO office first mentioned the existence of a new viral pneumonia) and the end of March 2020 (when the WHO characterized the novel COVID-19 epidemic as a pandemic), the total value of global trade of goods decreased by 35%, representing a drop of approximately USD 200 billions in trade flows. Global volumes of imports first declined by 11% in January 2020, and by an additional 13 percentage points between February and April 2020. The reaction of total exports appears later, with a significant 36% decline in the volume of exports between March and April 2020.1

Global trade volumes reached their lowest point since September 2019 between April and May 2020, but the summer showed signs of rebounds: in June 2020, global trade volumes were back to approximately 95% of their level of January 2020. The latest WTO forecast (October 2020) anticipates a 7.2% rise of global trade volumes for the year 2021.

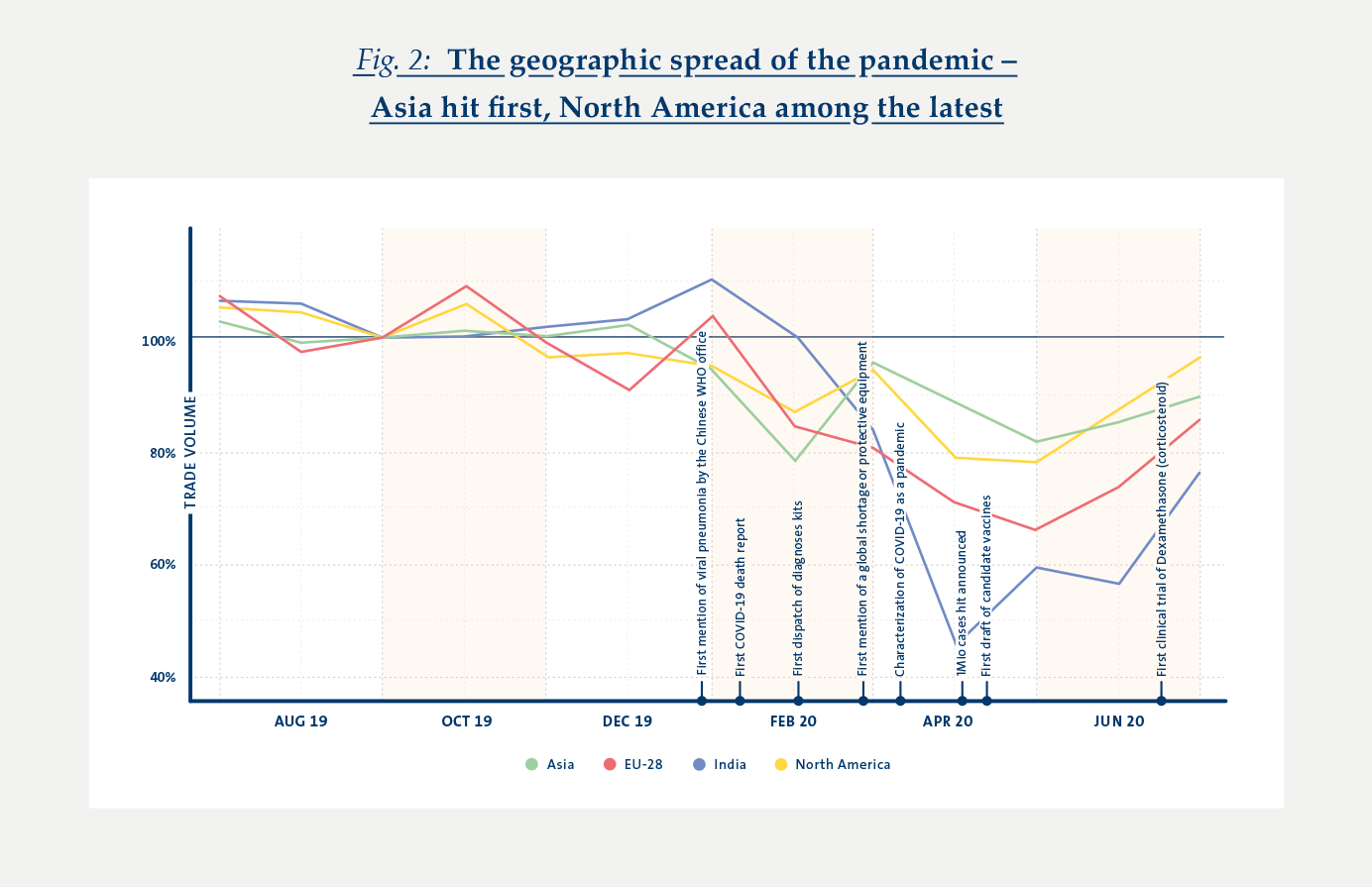

The geographic spread of the economic response to the pandemic from Asia towards the West is particularly clear when comparing trade volumes across regions. Asian imports started declining as early as during December 2019 and reached their lowest level in February 2020 (e.g. Japanese imports declined by 20% between January and February 2020), at which point India’s imports started dipping (-35% during January and March). The decrease in imports for the EU and North America became more pronounced towards the end of the quarter. The staggered response of export flows is even starker, with a 20% decline in Asian exports between December 2019 and January 2020, a 30% decline in Indian exports between February and March, while exports from EU and North America decreased by about 35% between March and April.2

The dynamics of import and export flows also suggests the importance of international and national political decisions in magnifying the response of global trade to the pandemic. The decline of imports in two waves (January–February 2020, and March– April 2020) suggests a significant impact of the social distancing and mass lockdown measures on individuals’ consumption imposed first in Asia and only a couple of months later in Europe and the United States.3 The rebound of aggregate trade during the summer of 2020 also coincides with a generalized reduction of sanitary restrictions across the globe.

The decline in exports starting March 2020 coincides with the implementation of severe export restrictions across the globe (the EU regulation 2020/402 on Personal Protective Equipment was implemented on March 15. 2020, a similar executive order was signed by the United States on April 3. 2020, and related measures have been adopted by a large array of countries in March-April 2020), and the expansion of travel restrictions between non-Asian countries (the WHO first quarantine advice was issued on February 29. 2020). While it is clear that the pandemic affected aggregate supply through a variety of channels including increased uncertainty, business closures and decline in intermediate inputs availability, the break in the times series in March 2020 emphasizes the aggravating effect of these export restrictions.

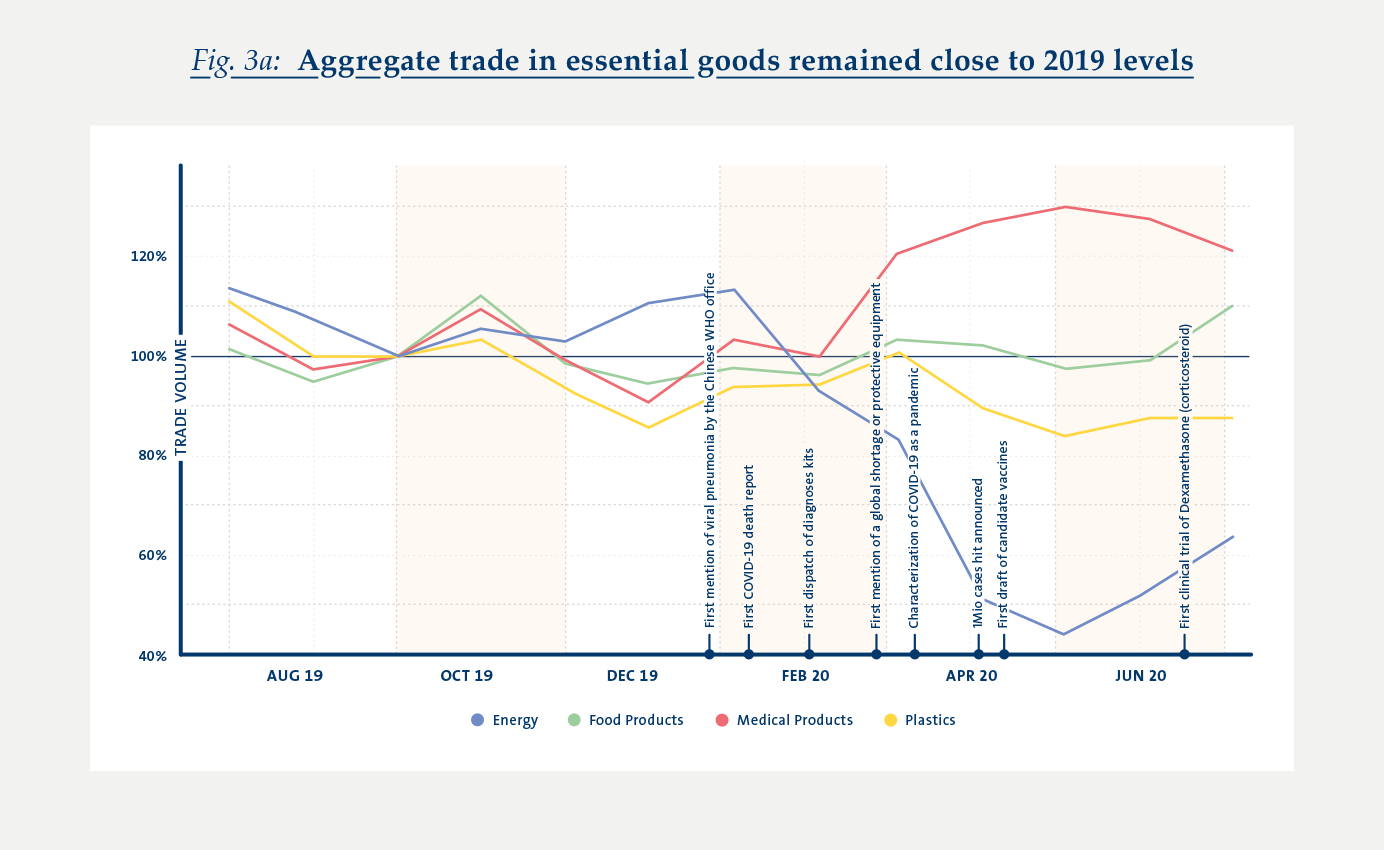

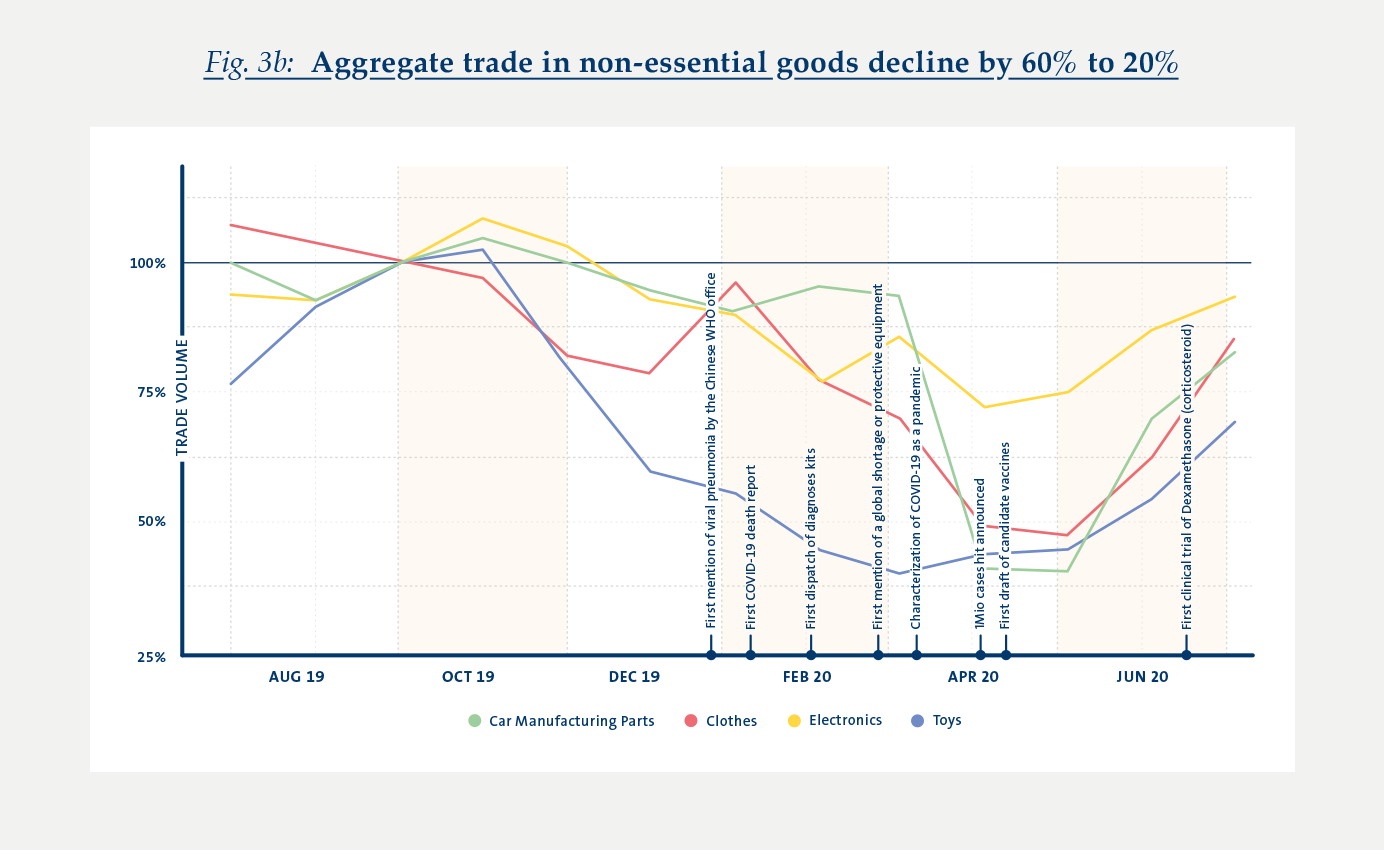

One of the key political concerns arising from the pandemic and justifying some of the restrictions mentioned above was national access to essential goods. We consider some of these key sectors, namely food products and energy, plastics and medical goods, and compare trade patterns in these goods with a selection of “non-essential” goods (clothes and apparel, electronics, toys and car manufacturing parts).4

Exchanges of energy-related goods (gasoline, fuel, diesel oil and natural gas) stand out from the group of essential goods, with a decline of trade volumes of 60% between January and May 2020. This decline is symptomatic of the global slowdown in trade of non-essential goods (between January 2020 and April 2020, trade volumes in car manufacturing parts declined by 65%, imports of apparel by 50%, and electronics by 20%) and restraints on individuals’ and goods’ mobility. To some extent, it is also a diagnostic test for the increase in trading and transportation costs throughout the period. Despite a 20 percentage points rebound in trade flows between May and August 2020, aggregate trade volumes of energyrelated goods remained 40% lower than their 2019 levels at the end of the summer 2020, while volumes of selected non-essential goods were back to their January levels. This may be indicative of delays in the economic recovery of some sectors, in particular transportation and tourism.

Trade in other essential goods, however, remained surprisingly strong between January and August 2020. The volumes of traded food products and plastics (polyethylene essential in the manufacturing of the majority of consumption and production goods) remained relatively close to their 2019 levels throughout the first six months of 2020. Exports of food products actually increased by 16% between January and March 2020, while trade volumes of plastics only declined by 10% between January and May 2020.

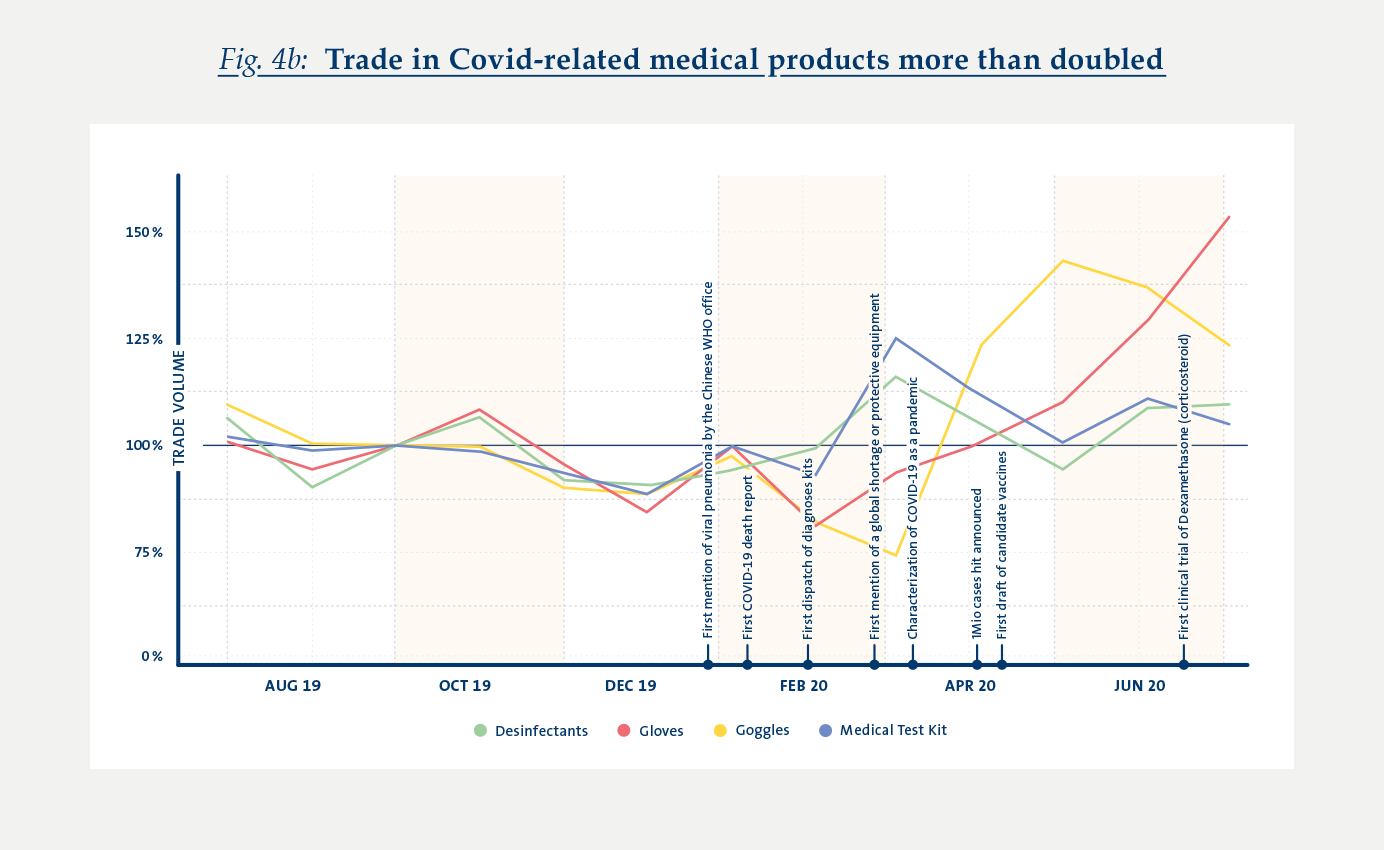

Despite the politically charged topic of access to medical testing kits, protective gears and respirators, trade in medical products remained strong throughout the first wave of the pandemic. International coordination seemed to have played a key role in that regards, as is evident from the 17% increase in trade volumes of medical products between February and March 2020, in the immediate aftermath of the first WHO dispatch of diagnoses kit.

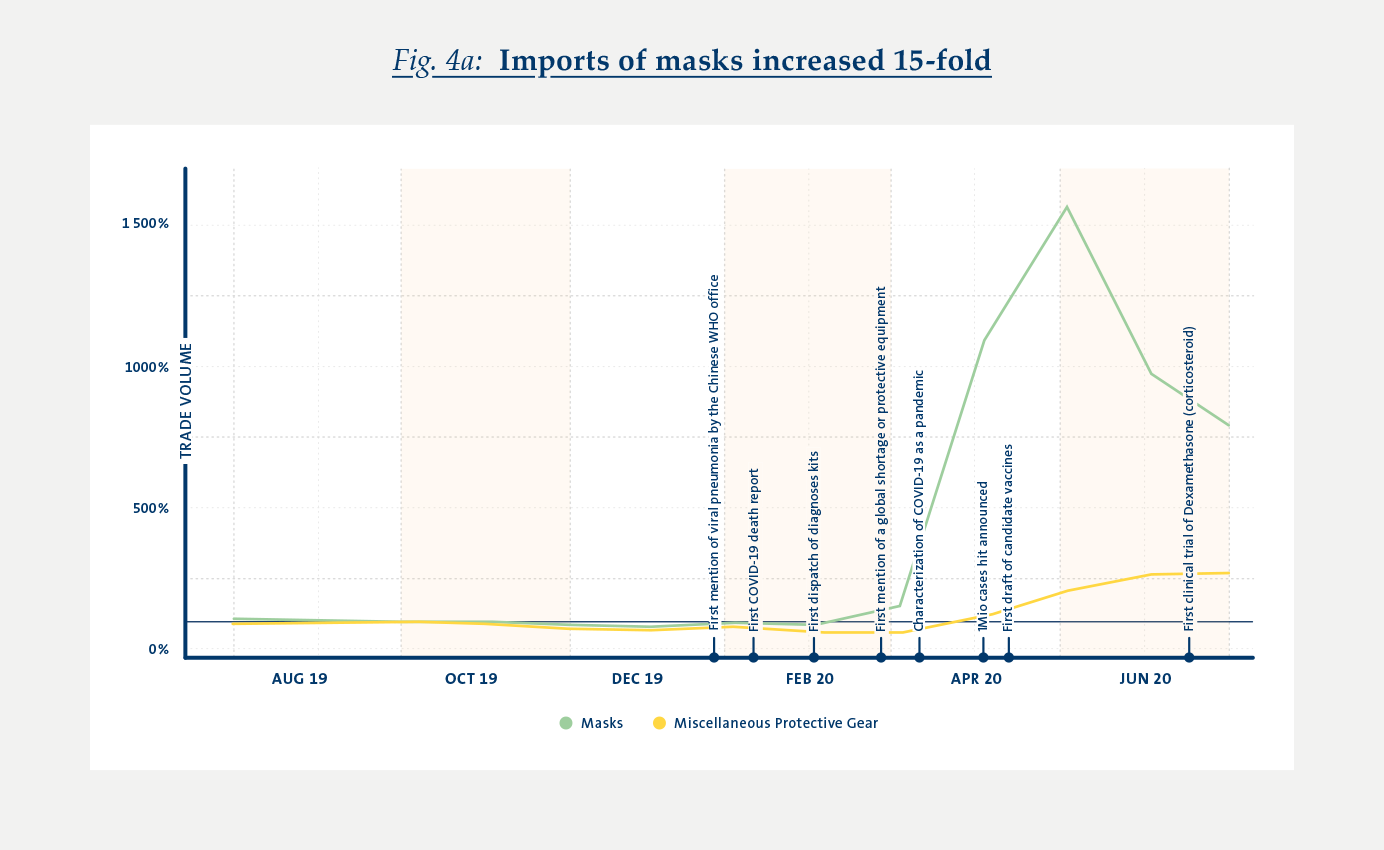

Zooming in on Covid-related medical goods, the large discrepancies between reported export and import flows reveals strong imbalances in the global supply of these goods, with China appearing as the lead exporter for the majority of these products.5

Between March and May 2020, the volume of imports of masks (in particular FFP2 and FFP3 masks for medical purposes, but also simpler chirurgical masks) increased more than 15-fold. This increase in nominal terms may reflect both the surge in demand for an item at the heart of many countries’ sanitary measures, and a possible surge in the price of these items. The total nominal value of imports of protective masks in May 2020 was USD 18 billions. Amongst other protective gears, imports of goggles increased by 46% relative to January 2020, and imports of gloves were 57% higher in July 2020 than in January.

In all these instances, excess global demand has been met by a drastic increase of the supply from Asia and in particular from China.

Trade in medical testing kits remained relatively more stable with a peak increase of imported volumes of 25% in March 2020. The role of the WHO in the distribution of medical testing kits is very clear in the time series: the increase in trade volumes in March 2020 can be directly associated with the first WHO official dispatch of kits. The stable level of traded volumes afterwards suggests a more balanced distribution of access to these goods across the globe.

These patterns of trade in Covid-related medical products are reassuring, as they show the resilience and flexibility of a quickly adapting global trade system.

Take Aways

The COVID-19 pandemic represents a perfect storm for a sharp decline of global trade, but the economic reaction to its initial shock is eminently political. While sanitary measures are critical in order to maintain national health care systems afloat, it appears that the combination of national shelter-in-place policies and exports restrictions magnified the initial shock of the pandemic. Amidst fear of a collapse of global trade, the evolution of exchanges of essential goods provides nonetheless some grounds for optimism, as they are indicative of the resilience of global trade.

The rebound of global trade in the summer of 2020 coincides with the loosening of social distancing in many countries. The upsurge in the number of cases in September 2020 confirmed fears of a second wave of the pandemic. Understanding how trade volumes adjusted to this expected second shock will be key in assessing the overall impact of the pandemic on global trade, and will be the object of a future Impact Series.

- For this analysis we use monthly trade volumes reported by COMTRADE. The set of reporting countries between August 2019 and August 2020 is not entirely stable, and some mirror exchanges are not reported. Amongst the most important missing reporters are China and South American countries. Imports from China are however clearly reported. This may generate non-negligible asymmetries between import and export flows.

- Data availability for low income countries is very limited, which limits the scope for sound interpretation of flows from Latin America and Africa.

- The most recent empirical studies on the topic of household consumption in times of Covid suggest that an initial response, in anticipation of the lockdown measure, was an increase in stockpiling behavior. In the context of the U.S. data suggest that the largest responses were observed for States with shelter-in-place measures (Baker et al. 2020).

- The definition of essential goods and sectors is presumably country-specific. We use a specific Swiss policy that imposes compulsory national stockpiling of essential goods to maintain supply in case of severe shortages to identify such goods.

https://www.bwl.admin.ch/bwl/ de/ home/ themen/ pflichtlager.html

The selection of non-essential goods is discretionary. - Imports of goods, and in particular of medical products from China, are reported by the majority of countries in the COMTRADE data. However, exports from China are not reported, leading to an apparent gap between import and export flows. Partial data on exports from Hong Kong SAR, China confirms that the observed patterns of imports of medical goods is mirrored by export patterns from Hong Kong.

- World Trade Organization Press Release 20-000, October 6. 2020

- S.R. Baker, R.A. Farrokhnia, S. Meyer, M. Pagel and C. Yannelis (2020).

“How does household spending respond to an epidemic? Consumption during the 2020 covid-19 pandemic” – NBER Working Paper 26949. - “Export Controls and Export Bans over the Course of the Covid-19 Pandemic: Export Restrictions Impair Ability to Respond to the Crisis” – WTO BDI Report, April 29. 2020

- Bericht zur Vorratshaltung 2019 – Schweizerische Eidgenössisches Departement für Wirtschaft, Bildung und Forschung WBF, Bundesamt für wirtschaftliche Landesversorgung BWL

- WITS Trade Statistics – List of medical products related to Covid-19 (HS 6-digit)

https://wits.worldbank.org/trade/ covid-19-medical-products.aspx

More Issues

Variable Carbon Pricing and the Environmental Gains from Trade

Optimal Carbon Tax for Maritime Shipping?

The Global Diffusion of Clean Technology

The Sustainable Globalization Index

The Distributional Effects of Carbon Pricing:

The Green Comparative Advantage:

Global Trade

The EU Emissions Trading System

The Hidden Green Sourcing Potential in European Trade

The European Green Deal

Post-COVID19 resilience

Africa’s Trade Potential

Buy Green not Local

A New Hope for the WTO?

Crumbling Economy, Booming Trade

EU Trade Agreements

Past, present, and future developments