Outline

In this Kühne Impact Series, we analyze the effects of the European Green Deal on international trade and transportation. Our main point is that the Green Deal marks a step change in the EU’s climate policy, which will transform European trade and transportation. In particular, by strengthening the EU Emission Trading System and introducing a Carbon Border Adjustment Mechanism, it will increase the carbon price towards its social optimum. This will incentivize households and firms to buy greener products, from greener countries, using greener transportation, and thereby contribute to a more sustainable globalization. In contrast, we believe that the new green agenda in the EU’s trade policy strategy, while ambitious in spirit, is less likely to have concrete effects.

An economic and geo-political outlook

Climate change is one of the defining challenges of our century. In response to this challenge, the European Commission has recently launched the so-called European Green Deal, which attempts to transform the European economy and make Europe the first climate-neutral continent globally by 2050.

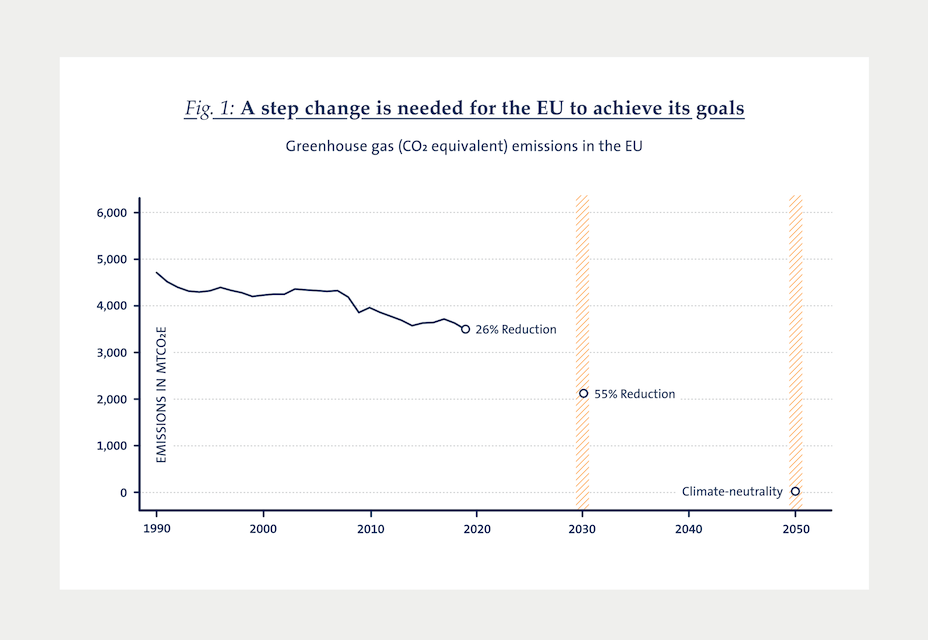

As a first step, the EU Member States have committed to reducing net emissions by at least 55% by 2030, compared to 1990 levels. In 1990, total emissions from all greenhouse gases in the EU reached 4,713.874 million metric tons of CO2. Since then, the level has been reduced by 26% (in 2019). Further actions are needed to achieve a 55% reduction by 2030 (see Figure 1).

In July 2021, the European Commission therefore presented the so-called “Fit for 55” package - a package of proposals aimed to ensure that the emission reduction target can be achieved.1 The proposed measures include changes in the EU’s internal production, consumption, and relationship with non-EU countries. The green agenda is also supposed to be reflected more broadly in all EU actions and policies, such as the EU’s new trade policy strategy. The “Fit for 55” package is still subject to negotiations by the European Parliament and the EU Member States.2

In this Kühne Impact Series, we analyze the effects of the European Green Deal on international trade and transportation. Our main point is that the Green Deal marks a step change in the EU’s climate policy, which will transform European trade and transportation. In particular, by strengthening the EU Emission Trading System and introducing a Carbon Border Adjustment Mechanism, it will increase the carbon price towards its social optimum. This will incentivize households and firms to buy greener products, from greener countries, using greener transportation, and thereby contribute to a more sustainable globalization. In contrast, we believe that the new green agenda in the EU’s trade policy strategy, while ambitious in spirit, is less likely to have concrete effects.

In the remainder of this Series, we develop this argument, looking at these three policy initiatives in turn.

Strengthening the EU Emission Trading System

The European Green Deal contains a vast number of proposals that are often essentially interlinked. However, the EU Emission Trading System (ETS) - EU’s carbon pricing instrument - is a cornerstone and key tool to achieve carbon neutrality. It is a “cap and trade” system, which sets an annual limit on the greenhouse gas emissions of covered entities. This cap is gradually reduced to achieve emission reductions. Within the cap, market players buy or receive emissions allowances, which they can choose to trade with one another, creating a price on emissions.

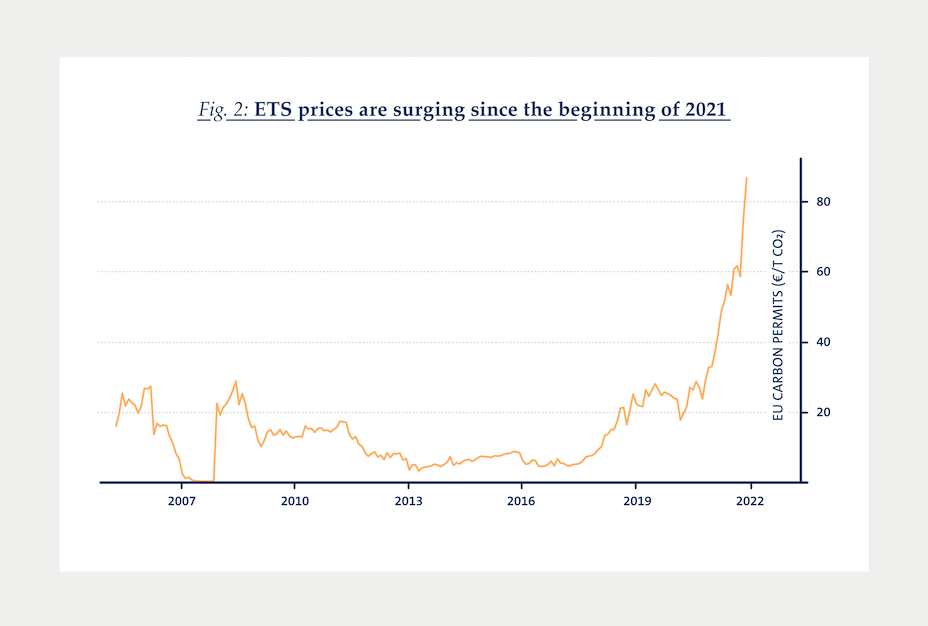

The experience with the EU ETS so far is mixed. On the one hand, several studies show that the system has proven effective at driving emission reductions.3, 4 Installations covered by the ETS reduced emissions by about 35% between 2005 and 2019. On the other hand, the pace of emission reductions has been too slow relative to EU goals. This is largely due to the fact that the ETS carbon price has long been below any reasonable estimate of the social cost of carbon, remaining below €10/tCO2 from 2013 to 2017 (see Figure 2). The main culprit of this is an over-supply of free allowances provided to producers at a high risk of carbon leakage.5 For example, more than 80% of allowances are currently allocated free of charge in some steel subsectors.

In light of this, the European Commission has proposed a substantial strengthening of the ETS as an essential part of the Green Deal initiative, involving a decrease of the emissions cap, a phase-out of free allowances, and an extension of the ETS to additional sectors. A look at the ETS prices suggests that market participants believe in the implementation of these new green commitments. In particular, the carbon price more than tripled to €90/t CO2 until the beginning of December 2021 relative to the 2019/2020 average value of €25/t CO2 (see Figure 2). Some studies estimate carbon prices to increase further up to €130/t CO2 for 2030.6

As part of this effort, the European Commission wants to broaden the EU ETS to more fully cover the transportation sector, with the overall goal of reducing transportation emissions by 90% by 2050. The current proposal includes an extension of the current EU ETS to the maritime sector for the first time in 2023-2025. Road transportation is suggested to be subject to emission trading starting 2026, with a separate system focused on upstream fuel suppliers. Moreover, the exceptions currently benefiting the aviation sector would be phased out.7

At this point, it is not straightforward to estimate the potential effects on the costs of the transportation sector. A key question is whether the transportation sector would have to buy allowances or obtain them free of charge. Nevertheless, being included in the EU ETS would generate incentives to decarbonize transportation either way. In particular, even freely allocated emission allowances provide incentives for investing in emission reductions, given that unused allowances can be sold.

Overall, the reforms proposed by the European Commission would amount to a substantial strengthening of the EU ETS, turning it into a more powerful tool in the fight against climate change. Higher ETS prices and an expanding ETS coverage would bring the continent closer to having a socially optimal carbon price, even though the system would continue to have many blind spots.

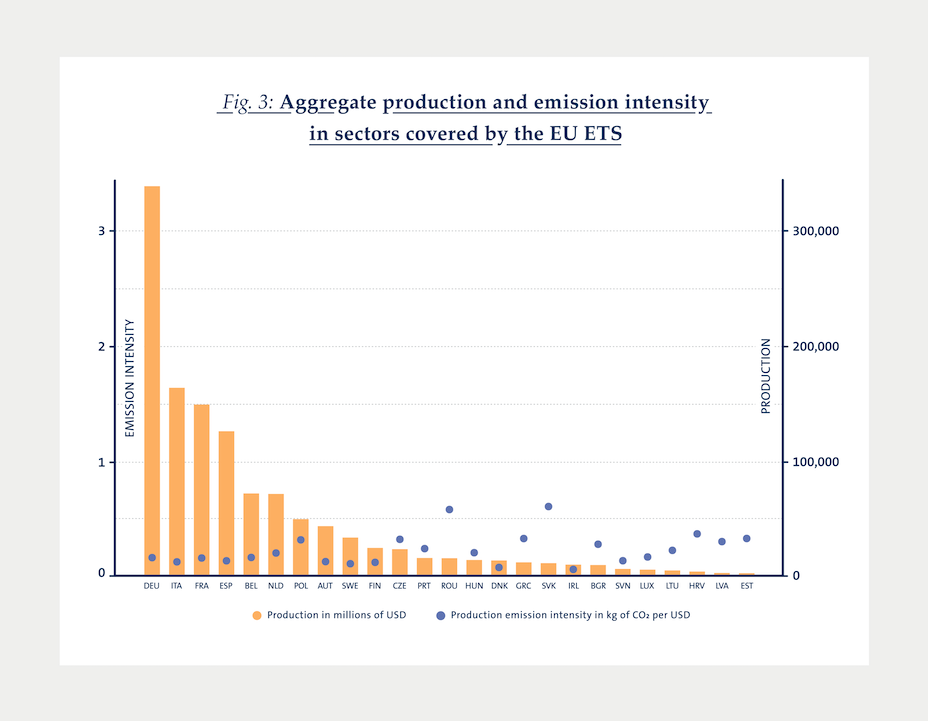

As a result of these reforms, we expect trade patterns within the EU to shift significantly. Specifically, production and export volumes will likely move towards greener countries, greener sectors, and greener transport modes over time, as a higher carbon price penalizes emission-intensive activities. This would imply more sustainability in intra-European trade.

Figure 3 provides a sense of the likely winners and losers of this change by showing European countries’ emission intensities and their production volumes of goods covered by the ETS system. Not surprisingly, the four biggest EU economies are the main producers of products under the current ETS scope (iron and steel, aluminum, and fertilizers). In terms of emission intensity, they are relatively efficient, performing better than Eastern EU countries. A steep increase in ETS prices might shift production from relatively highly polluting countries such as Romania, Slovakia, Poland, and the Czech Republic towards greener economies. This will most probably benefit the biggest EU’s economies and, without some adequate compensation mechanisms, could exacerbate the polarization within EU countries.8

Introduction of a Carbon Border Adjustment Mechanism

An increased price on carbon is likely to affect European firms’ competitiveness both in the home market and globally, impacting trade patterns between EU and third countries. In particular, European firms’ market share within Europe and their export market share to third countries may be reduced relative to firms that do not face carbon prices. Moreover, a major concern associated with increased carbon prices in the EU is that it could induce carbon-intensive production to shift abroad. If production moves to more carbon-intensive countries, such leakage could even increase overall emissions, making the EU carbon price counterproductive.

Historically, the EU ETS does not seem to have triggered substantial carbon leakage in the sectors in which it is applied. A 2020 OECD report shows little change in foreign emissions embodied in domestic final demand in EU countries.9 However, this assessment concerns a period of generous anti-leakage measures, such as the free allowances for producers in some steel subsectors mentioned above. Therefore, it is unlikely to provide a reliable guide to the potential carbon leakage associated with a strengthened EU ETS.

To tackle and prevent carbon leakage, the Commission has therefore issued a proposal for stablishing a Carbon Border Adjustment Mechanism (CBAM). If implemented, this would be the world’s first system of carbon tariffs. The CBAM would ensure equivalent carbon pricing for imports and domestic products and thereby level the playing field in the European market between the EU and third-country producers for the sectors covered by the EU ETS.

To preserve its effectiveness as a carbon leakage measure, the price of CBAM certificates has to reflect the EU ETS price closely. While the price of EU ETS allowances is determined through auctions, the price of the CBAM certificates is suggested to be calculated as the weekly average of the ETS prices. Moreover, the CBAM certificates would be based on actual emissions of imported goods. This approach should ensure fair and equal treatment of all imports, encourage the use of more emission-efficient technologies by producers in third countries, and, importantly, make the CBAM compatible with WTO rules and other international commitments.10

To ensure a prudent and predictable transition, the Commission proposes that the CBAM should be implemented in 2026, following a transition period of three years characterized by data collection only. The suggestion is to have the CBAM progressively phased in while free ETS allowances in sectors covered by CBAM are phased out by 10 p.p. per year between 2026 and 2035.

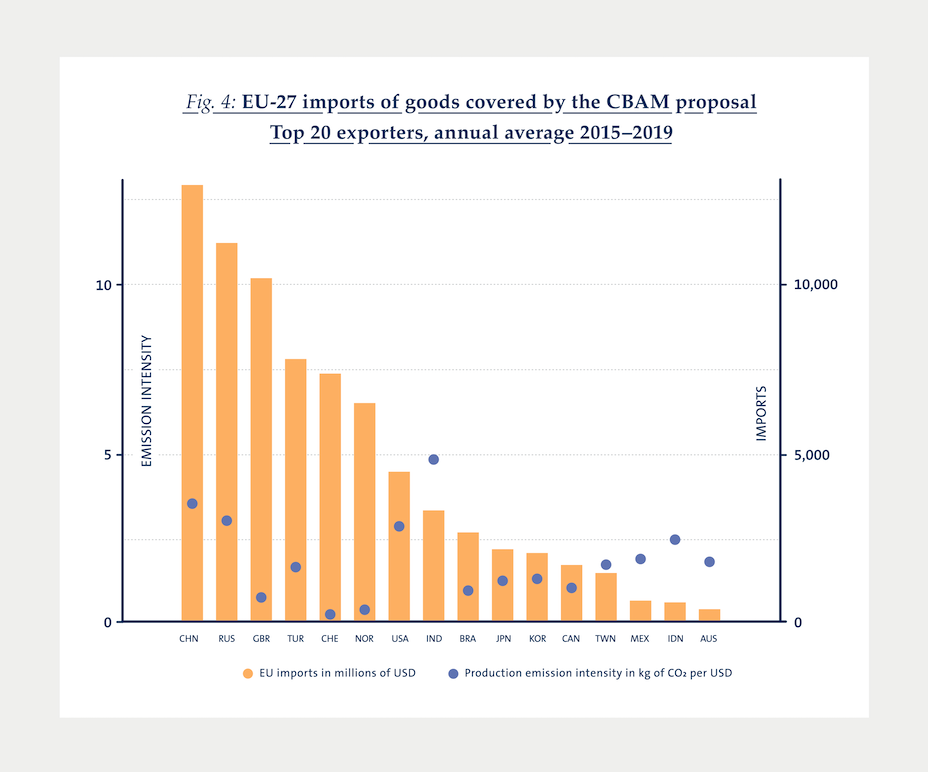

If successfully implemented, we believe the CBAM would contribute to leveling the playing field between European firms and third-country competitors in the European market. As a result, some of the previously mentioned effects of the EU ETS on the European market, such as a shift towards greener source countries and greener products, would extend to import patterns from third countries. According to our calculations, China, Russia, Turkey, USA, and India are the five countries that would be most affected by the introduction of the suggested CBAM (see Figure 4).11 Together these five countries account for 43% of EU imports of products covered by the CBAM. Although the emission intensity in these five countries varies, they all currently exceed the average emission intensity in Europe.12

While addressing concerns about carbon leakage and competition in the European market, the proposed CBAM would not level the playing field between European firms and third-country competitors in third-country markets. If higher carbon prices reduce the competitiveness of producers in European countries compared to producers in third countries, firms in the EU may lose export market shares in third-country markets. Such a situation may still imply a transfer in production to countries with less emission constraints, leading to carbon leakage.

EU Trade Policy Strategy

In line with the Green Deal, the EU has also adopted a new trade strategy that integrates environmental concerns into its external relations and trade policies. In theory, this could induce a more sustainable global economy.

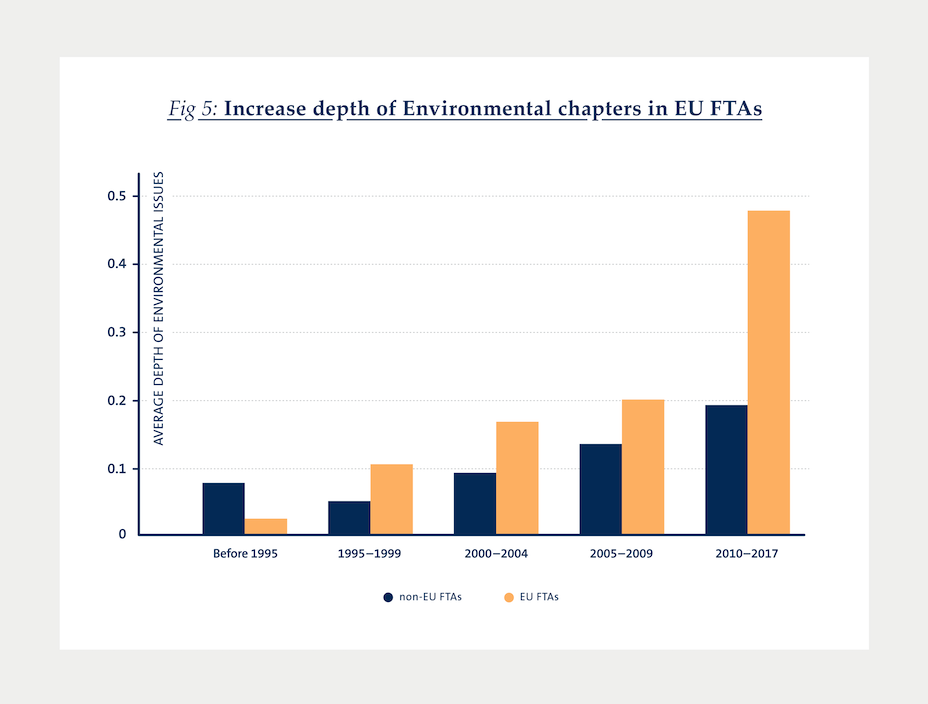

As the world’s largest trading bloc and the top trading partner for 80 countries, the EU could considerably impact third countries through trade.13 This impact includes how international trade is conducted but also how environmental and wider sustainability-related aspects are addressed. The EU has used its influence to include environmental provisions as part of the Trade and Sustainable Development (TSD) chapter in trade agreements.14 As illustrated in Figure 5, the depth of Environmental chapters within EU FTAs has increased both in absolute terms and relative to non-EU FTAs.15

However, these environmental provisions lack enforceability. While this has allowed the EU to incorporate more aspirational language in its FTAs, it has simultaneously weakened the credibility of the environmental standards included in the trade agreements. In fact, if a country refuses to comply with the sustainability standards stated in the TSD Chapter, no sanctions are envisaged. This happened in January 2021, when a panel of experts confirmed that South Korea breached labor commitments under the trade agreement with the EU, but no further concrete or economic measures could be taken within the current framework.

The EU strives to achieve higher environmental goals in the new trade strategy. At the multilateral level, the aim is to set an environmental agenda at the WTO. Bilaterally, the EU proposes to include the Paris agreement as an essential element in all future agreements, while commitments of carbon neutrality will be sought for FTAs with G20 countries. The Commission also wishes to improve the implementation and enforcement of the TSD Chapter of FTAs. Although the trade strategy formulates an agenda for greener trade policy, the actual course of action and enforceability remains unclear. Therefore, the implications of the EU’s new trade strategy on international trade and transportation, if any, are far less certain at this point.

However, other trade policy initiatives, with more clear implications, have been taken. Specifically, initiatives to prevent environmentally harmful products from entering the EU market have been announced. This includes a proposal to prevent importing of goods linked to deforestation,16 demands of higher agricultural standards for imported goods,17 and the phasing out of non-sustainable imports to promote a circular economy. If implemented, these measures are more likely to affect trade patterns directly.

Concluding remarks

Climate change poses an immense threat to our societies. A swift reduction of emissions is needed to tackle this. The European Green Deal aims to achieve this by transforming the European economy, making Europe the first climate-neutral continent globally by 2050.

We believe that the “Fit for 55” package - if fully implemented - marks a step change in the right direction. Nevertheless, to be effective, it is crucial for policy makers to adopt it in its entirety promptly. While it may not go all the way, it would bring Europe substantially closer to a sustainable pattern of trade and transportation. For the first time, market participants seem to believe in the implementation of these new green commitments, as reflected in the recent surge in the EU carbon prices. As we have made clear, implementation of the package will have important implications for firms, requiring adjustments to internalize higher carbon prices and tackle possible reduced competitiveness in third-country markets.

Finally, we think that the EU, given its predominant role in global trade, should be more ambitious in tying in environmental concerns within trade relations. The newly announced trade policy strategy is clearly an attempt in this direction, but it is still too vague and lacks clear economic and political implications in its current form. Environmental concerns are a global phenomenon. Therefore, the EU needs to push for more binding environmental provisions in its bilateral agreements, as well as in the multilateral arena, to pave the road for a more sustainable globalization worldwide.

- European Union: European Commission, Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions empty: “Fit for 55” - delivering the EU’s 2030 Climate Target on the way to climate neutrality, 14 July 2021, COM(2021) 550 final, available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021DC0550 [accessed 16 November 2021]

- It has, however, already been criticized by climate activists for not being enough to keep global heating below 1.5°C. Climate and environmental activist Greta Thunberg tweeted “So it’s official. Unless the EU tear up their new #Fitfor55 package, the world will not stand a chance of staying below 1.5°C of global heating. That’s not an opinion, once you include the full picture, it’s a scientific fact. #MindTheGap between words and action.” https://twitter.com/GretaThunberg/status/1415353709979111429

- https://ec.europa.eu/clima/eu-action/eu-emissions-trading-system-eu-ets_en

- https://www.pnas.org/content/117/16/8804

- Carbon leakage refers to the situation that occurs if, for reasons of costs related to climate policies, businesses choose to transfer production to other countries with less emission constraints. We return to the issue of carbon leakage below.

- https://www.sciencedirect.com/science/article/pii/S0306261921003962

- The emission trading is suggested to be complemented by a series of other policies targeting the transportation sector. These include a faster rollout of low emission transport modes and the infrastructure and fuels to support them, the use of more sustainable fuel in the aviation and maritime sectors, and a fuel-tax system to impose minimum levies on both shipping and aircraft sectors.

- It is important to keep in mind that the emission intensities of countries, sectors, and transport modes are likely to change themselves as a result of the higher carbon price as firms adopt cleaner technologies. This would then further change the pattern of transportation and trade.

- https://www.oecd.org/sti/ind/TECO2_OECD_webdoc2020.pdf

- While WTO compatibility is the objective of the Commission, this does not exclude the possibility of other countries contesting the implementation of the CBAM in the judicial body of the WTO.

- Note that the CBAM is suggested to apply only on imports from countries that do not impose a price on carbon similar to the EU ETS. As the United Kingdom has started implementing its own ETS system, it would not be directly affected by the European CBAM if prices of allowances in the UK and EU converge. Moreover, Norway and Switzerland (together with Iceland and Liechtenstein) are proposed to be outside the scope of the regulation.

- https://data.worldbank.org/indicator/EN.ATM.CO2E.KD.GD?end=2015&start=1960&view=chart

- https://ec.europa.eu/trade/policy/eu-position-in-world-trade/

- https://ec.europa.eu/trade/policy/policy-making/sustainable-development/

- The figure uses the new World Bank dataset on the depth of trade agreements, constructed by Mattoo, Rocha, and Ruta (2020). Source: https://datatopics.worldbank.org/dta/table.html

- https://ec.europa.eu/commission/presscorner/detail/en/ip_21_5916

- https://ec.europa.eu/food/horizontal-topics/farm-fork-strategy_en

More Issues

Variable Carbon Pricing and the Environmental Gains from Trade

Optimal Carbon Tax for Maritime Shipping?

The Global Diffusion of Clean Technology

The Sustainable Globalization Index

The Distributional Effects of Carbon Pricing:

The Green Comparative Advantage:

Global Trade

The EU Emissions Trading System

The Hidden Green Sourcing Potential in European Trade

Post-COVID19 resilience

Africa’s Trade Potential

Buy Green not Local

A New Hope for the WTO?

Crumbling Economy, Booming Trade

Pandemic and Trade

The Dynamics of Global Trade in Times of Corona

EU Trade Agreements

Past, present, and future developments