Outline

This Kühne Impact Series focuses on the EU Emissions Trading System, a cornerstone of the European Green Deal and Europe’s attempt to reach climate neutrality by 2050.1 We discuss how the system has been developed, creates a price on carbon, and the efficiency of the allocation of emissions allowances. Moreover, we analyze the evolution of the EU ETS prices and discuss the recent substantial volatility in the price of the carbon permits. The experience with the EU ETS has been mixed. However, we believe that recent and expected developments will make the system more resilient and reliable – and can ensure a credible and efficient path to carbon neutrality.

Launched in 2005, the European Union Emissions Trading System (EU ETS) was the worldʼs first greenhouse gas emissions trading scheme, and it remains the largest. The system currently limits emissions from around 10,000 installations, covering emissions from the power generation sector, industry, and intra-European flights, amounting to about 40% of the EUʼs greenhouse gas emissions. Further strengthening and broadening of the EU ETS is a substantial part of the so-called “Fit for 55” package, which declares the EU ETS as a critical tool for reducing greenhouse gas emissions by at least 55% by 2030 (compared to 1990 levels), and reaching climate neutrality by 2050.2, 3

The EU ETS currently limits emissions from the power generation sector, industry, and intra-European flights, amounting to about 40% of the EUʼs̓ greenhouse gas emissions.

The EU ETS is a so-called cap-and-trade system. This means that governments set a maximum (“cap”) on the total amount of certain greenhouse gases emitted by all installations covered by the system over a certain period. Tradable emissions permits are then issued within the cap, and emitters bound by the scheme must hold enough permits to cover their annual emissions. The cap is gradually reduced to achieve emissions reductions.

The emissions permits are allocated for free or sold through auctions, and they can be sold and bought as needed on a traded market. Each allowance gives the holder the right to emit one tonne of carbon dioxide (CO2) or the equivalent amount of other powerful greenhouse gases (nitrous oxide and perfluorocarbons).

Companies face a fine of 100 euros per excess tonne if they emit more than they have covered and must also obtain allowances to make up the shortfall in the following year.

The development of the EU ETS: 4 phases

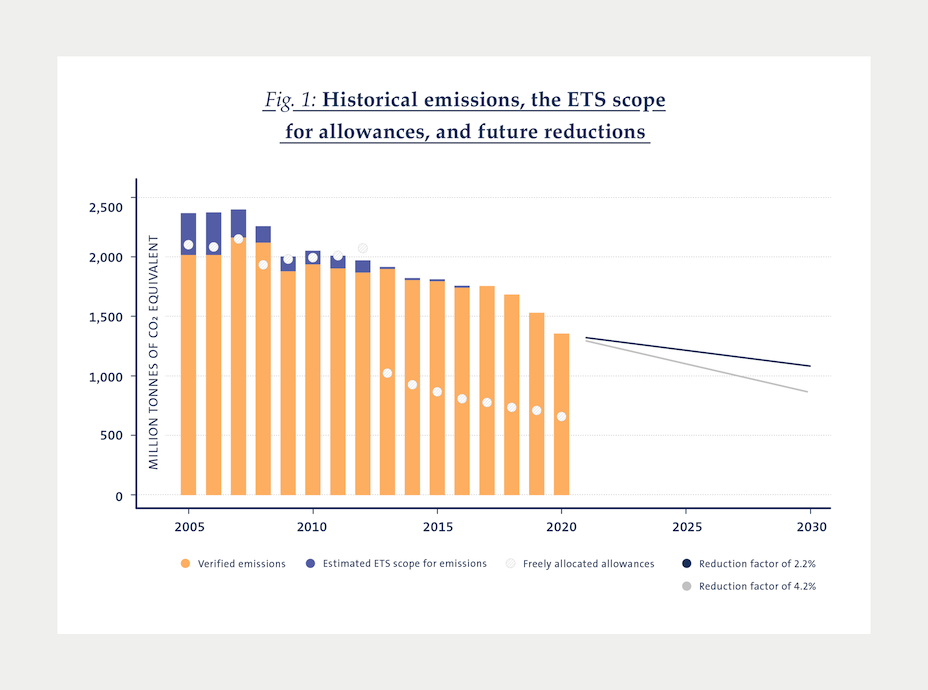

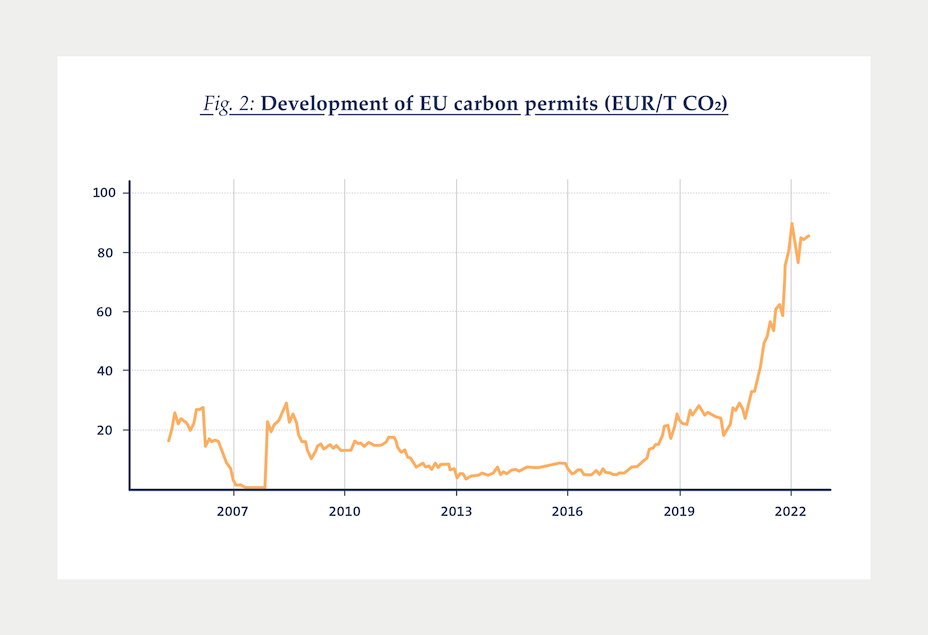

In the first trading period of the EU ETS (2005–2007), known as the pilot phase, most allowances were given out for free and in generous amounts. The main reason for the over-supply of free allowances was an absence of reliable emissions data, but also to reduce risks of carbon leakage and allow time for green investments.4 The pilot phase succeeded in establishing the infrastructure for the EU ETS. However, as illustrated in Figure 1, the number of allowances issued exceeded the amount of actual emissions, resulting in a low price of emissions, which eventually reached zero in 2007 (Figure 2).

In phase 2 (2008–2012), the cap on allowances was slightly reduced (by 6.5% compared to 2005), but the supply of emission allowances still exceeded the demand, resulting in a continuing low price. The excess supply was partly explained by the 2008 economic crisis leading to reduced demand for emissions. In its third phase (2013–2020), the cap was set to be reduced by 1.74% per year to reduce emissions by 21% in 2020 (compared to 2005). Moreover, freely distributed allowances dropped considerably, and 40% of allowances were auctioned instead.

In the fourth and ongoing phase (2021–2030), the cap on emissions decreases at an increased annual linear reduction rate of 2.2%. Around 57% of the allowances are auctioned, while the rest is provided for free. The fourth phase is, however, expected to be strengthened as the “Fit for 55” package suggests that the reduction factor will be increased to 4.2% in 2024. There is also a push to reduce the freely allocated allowances faster.5

Efficiently decreasing pollution

The reduction in emissions allowances implies an increased competition for the available allowances and an increased price on emissions. This increased price becomes an additional cost for companies, which can be reduced by decreasing emissions, for instance, by investing in “cleaner” technologies.6 Companies with the lowest willingness to pay for allowances are predicted to be the first to decrease emissions. Their low willingness to pay may reflect that the transfer to greener production technologies is easier or cheaper for these companies, i.e., the cost of investing in new production methods is lower than the price of emissions allowances when the price of carbon is relatively low. By first reducing emissions where the transition to greener production is least costly, the EU ETS decreases pollution efficiently.7

By first reducing emissions where the transition to greener production is least costly, the EU ETS decreases pollution efficiently.

Optimal ETS price

The ETS price has increased drastically in the last few years, from €20/t in 2020 to above €90/t in 2022. In February 2022, the European carbon permits reached their maximum value at €96.7/t. Different explanations have been given for this quick acceleration, and they can mainly be classified into two categories: changes in public policies and demand-side factors. Specifically, the fast acceleration in prices was driven by the beginning of phase 4 of the ETS and the announcement of the “Fit for 55” package, together with particularly cold weather in Europe, which caused energy demand to rise, and higher gas prices, pushing electricity producers to switch to more CO2-intensive power sources.

A question that might arise is whether the price of the ETS has reached the optimal equilibrium price to induce substantial CO2 emissions reductions and incentivize firms to invest in greener technologies. Without drastic investments in greener technologies, the more the cap is reduced – following the path towards carbon neutrality by 2050 – the more the price of the ETS is expected to increase. The only way to stabilize prices would be if the reduction in carbon permits allocated to the market is matched by a reduction in the demand for allowances. Given the high uncertainty in green technological progress in the near future, it is hard to predict how and if this will happen and thus to forecast the evolution of the ETS prices correctly.

The social cost of carbon (SCC) might, however, provide insight into what the optimal price should and will be. The SCC is defined as the marginal cost of the impacts caused by emitting one extra tonne of greenhouse gas at any point in time. In 2018, the Intergovernmental Panel on Climate Change of the United Nations suggested that a carbon price of $135–$5,500/t in 2030 and $245–$13,000/t in 2050 would be needed in order to meet the global warming target of 1.5°C set by the Paris Agreement. The cost for limiting warming to 2°C is suggested to be about 3–4 times lower. The wide range of these price predictions is a strong signal of the high uncertainty about the efficient path to achieving carbon neutrality by 2050.

Price volatility

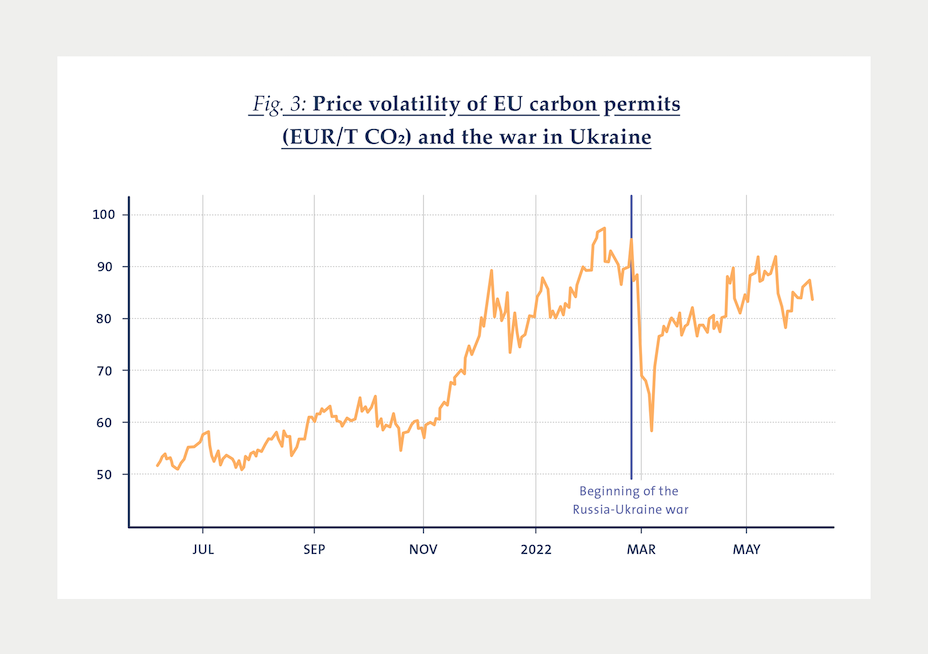

Despite the recent steady increase, the ETS price has also experienced some severe fluctuations and price falls in the last few months. The day before the Russian invasion of Ukraine, the price of the EU ETS closed at €95.07/t. By March 7, it had slumped to €58.30, almost a 40% fall. Drastic falls in ETS prices are not unprecedented. Over a decade ago, during the 2007–2008 global financial crisis, the price of CO2 allowances in the EU collapsed from almost €30/t in June 2008 to barely €9/t by the following February, only to languish in single digits for the next decade.

However, these two collapses were different. The great recession drastically reduced the worldwide (and European) economic activity, negatively affecting the demand for allowances. Since there were no good systems to address the overhang of allowances, this resulted in depressed prices for a decade. The price collapse induced by the Russia-Ukraine war is a bit more puzzling. ETS prices usually move with energy prices, but they seem to have decoupled in the last months. Given how much European countries rely on Russian gas, one would have expected the price of the ETS to go up, assuming that electricity producers would have had to switch to more CO2-intensive power sources, like coal. But the short-term sell-off of carbon permits had little to do with longer-term considerations. Instead, it was mainly due to some risk-off sentiment. There has been a general liquidation of positions by investors: some traders liquidated their ETS to meet margin calls in other rising energy markets; other investors fled into safer markets, fearing a potential fallout of sanctions on the EU; finally, there have also been speculations that some sellers included Russian traders, repatriating assets to avoid sanctions. These are signs of financial speculations happening in the carbon pricing market.

The financial speculation, and more precisely the recent roller coaster ride of ETS prices, might be detrimental to the efficiency of the carbon pricing market. High price volatility could result in high uncertainty in the overall cost of polluting for installations covered by the ETS system, reducing the incentive to move towards greener technologies.

The policy changes that have supported ETS prices to surge last year could also help stabilize prices going forward. For instance, the carbon price has recovered quickly since it reached its lowest point on March 7. The benchmark contract reached €80/t by the end of March – one month after the beginning of the war – and close to €90/t in May. Two reasons that helped the fast recovery of the ETS price are the Market Stability Reserve and the long-term policy commitment by EU member states to reach net-zero emissions by 2050. Still, extreme price fluctuations can produce harmful effects in the short term. Only during May, the price of the ETS oscillated between a maximum of €92/t to a minimum of €77/t. This suggests that the newly implemented instruments regulating the carbon market seem to be ineffective in stabilizing prices in the short term, even more so if the financial speculation in the ETS market were to increase.

The role of financial institutions in the ETS market has attracted the attention of policymakers and has been examined by the European Securities and Market Authority (ESMA). In a recent report, ESMA highlights that the number of financial entities with limited direct connection to the regular functioning of the ETS market has grown in recent years.8 Specifically, about 50% of positions are held by non-financial players as commercial undertakings. While EMSA highlights that financial institutions play a crucial role in keeping the market for carbon allowances more liquid, they have also raised concerns regarding the increased involvement of financial players in the ETS, and its effect on price volatility, calling for further investigation, monitoring, and possibly limiting financial investors’ future access to the system. Similar views have been expressed by the European Parliament.9

Towards broader coverage, a lower cap and reduced surplus of allowances

During its first phases, the experience with the EU ETS was mixed, and much criticism was directed at the low price of carbon emissions due to the oversupply of permits. As the system has developed and become more binding, there are reasons to be more optimistic. Further reductions of the emissions cap, phaseout of free allowances, and extension of the ETS to additional sectors will help ensure a faster transformation towards carbon neutrality. The broadening of the ETS to the maritime sector, road transportation, and fully covering the aviation sector are essential parts of this. Moreover, as of 2019, a new instrument has been introduced to curb the surplus of emissions allowances, the Market Stability Reserve (MSR). The objectives of the reserve are twofold: absorb the surplus of allowances from phase 3; and increase the resilience of the system, by adjusting the number of allowances to be auctioned in the future.10 The MSR has contributed to the steady increase of ETS prices over the last 2 years, achieving its first objective. The quick recovery of ETS prices – following the collapse induced by the Russia-Ukraine war – also showed how the MSR was able to cope with major shocks by making the market more resilient, in line with its second objective.

There is a broad consensus that by reducing the surplus of allowances, and thus stabilizing the ETS price, the MSR is a necessary tool for allowing the EU to reach its emissions reduction target. A main outstanding issue is whether the allowances in the reserve will be canceled at a sufficiently fast pace, rather than stored and used as a future buffer in a way that will prevent the EU from following its emissions reduction trajectory.

Concluding remarks

Climate change poses an immense threat to our societies, and the need to reduce emissions is acute. Putting an efficient price on emissions is crucial to decrease pollution and help combat this threat. We believe using a market-based cap-and-trade system to create a price on carbon can ensure a credible path to carbon neutrality.

The EU ETS system reduces emissions by operating on the quantity of carbon allowances issued. This market-based mechanism automatically creates an efficient price for carbon permits to achieve the EU reduction target. The recent developments of the EU ETS and the further strengthening proposed by the Commission will make the system more resilient and reliable. These positive effects can be seen by analyzing the evolution of the ETS prices in the last few years.

We believe that this system is capable of decreasing pollution efficiently. However, challenges still remain and include ensuring the capacity to handle potential new surpluses of allowances, setting up a well-functioning carbon border adjustment mechanism to avoid carbon leakage, and limiting excess price volatility.

- In a previous Kühne Impact Series we have analyzed the European Green Deal – i.e., the EUʼs attempt to transform the European economy and make Europe climate-neutral by 2050 – and its effect on international trade and transportation. The European Green Deal: Transforming International Trade and Transportation, Kühne Impact Series 06/21, available at: https://www.kuehnecenter.uzh.ch/impact_series/2021_12_21-06-21-european_green_deal.html

- European Union: European Commission, Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions: ‘Fit for 55’: delivering the EUʼs 2030 Climate Target on the way to climate neutrality, 14 July 2021, COM(2021) 550 final, available at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A52021DC0550 [accessed 16 November 2021]

- The proposal to amend the ETS consists of five elements: i) a reduced cap and more ambitious linear reduction factor for GHG emissions, ii) revised rules for free allocation of allowances and the market stability reserve, iii) an extension of the ETS to maritime transport, iv) a separate new ETS for buildings and road transport, and v) an increase of the Innovation and Modernisation Funds and new rules on the use of ETS revenues.

- Carbon leakage refers to the situation that occurs if, for reasons of costs related to climate policies, businesses choose to transfer production to other countries with less emissions constraints.

- Each phase also brought other significant changes, such as an increased number of participating countries and an extension of the activities and greenhouse gases covered.

- This assumes that measures are in place to prevent carbon leakage.

- In principle, the free allocation of emissions allowances does not contradict the efficiency argument, although it does directly contradict the “polluter pays” principle.

- ESMA: Final Report on the European Union Carbon Market 28 March 2022, available at: https://www.esma.europa.eu/press-news/esma-news/esma-publishes-its-final-report-eucarbon-market

- See for instance https://energypost.eu/options-to-reform-the-eu-ets-coping-with-price-volatilityand-speculation-event-summary/https://www.europarl.europa.eu/doceo/document/P-9-2021-001871_EN.html

- If the total number of allowances in circulation is greater than 833 million, 24% (12% from 2024 onwards) of the allowances in circulation will be placed in the reserve. If, on the contrary, the total number of allowances in circulation is lower than 400 million, then 200 million allowances will be released from the MSR (100 million from 2024 onwards). The “Fit for 55” proposal to revise the MSR consists of prolonging its current parameters to 2030.

More Issues

Variable Carbon Pricing and the Environmental Gains from Trade

Optimal Carbon Tax for Maritime Shipping?

The Global Diffusion of Clean Technology

The Sustainable Globalization Index

The Distributional Effects of Carbon Pricing:

The Green Comparative Advantage:

Global Trade

The Hidden Green Sourcing Potential in European Trade

The European Green Deal

Post-COVID19 resilience

Africa’s Trade Potential

Buy Green not Local

A New Hope for the WTO?

Crumbling Economy, Booming Trade

Pandemic and Trade

The Dynamics of Global Trade in Times of Corona

EU Trade Agreements

Past, present, and future developments