Impact Series: 03-23

The Sustainable Globalization Index

Historical divergence and future convergence to Sustainable Globalization

Outline

In this Kühne Impact Series we provide a historical perspective on globalizationʼs contribution to climate change, and the historical role of trade in bringing us closer to (or further away from) a sustainable world. We introduce the Sustainable Globalization Index (SGI) that tracks the worldʼs progress towards a Sustainable Globalization scenario. The SGI reveals that globalization has historically diverged from a sustainable pattern of trade until the Great Recession, but is now on a converging trend. The comparison in the recent period suggests that the (green) future of trade and logistics involves more trade from and to the economic North, more intraregional trade, and a shift of trade flows in favor of energy and raw materials and away from agricultural goods.

At the Kühne Center for Sustainable Trade and Logistics, we advocate that it is crucial to embrace international trade in the fight against climate change. The Kühne Center defines environmentally sustainable globalization as the global pattern of trade that would prevail if carbon were priced at its social cost. While this pattern cannot be observed in the data, it can be approximated with the help of quantitative trade models.

In a companion Kühne Impact Series, we elaborate on such a quantitative framework and simulate patterns of production and trade in the context of uniform and global carbon tax.1 One of the key messages is that a uniform global carbon tax is a highly efficient tool to reduce greenhouse gas emissions: a global carbon tax of just $100/tCO2 would reduce current emissions by 27.5%, while only costing a decline in real income of 0.7%.

Moreover, we show that a world where carbon is priced at its social cost is a world with significant international trade. There are large environmental gains from trade arising when countries specialize according to their green comparative advantage. In a world where carbon is taxed at $100/tCO2, we find for example that the share of output traded in the brownest sectors (such as mining products, industrial coal or metals) increases in response to an intensifying of the green sourcing of such products, and that the poorer browner countries with strong natural resources (e.g., Cambodia or Chile) specialize in their green comparative advantage sectors and become therefore more integrated to international trade.

In this Kühne Impact Series, we label this counterfactual world where carbon emissions from production and consumption are taxed globally and uniformly at $100/tCO2 as “Sustainable Globalization.” We use this as our benchmark to gauge how current and historical patterns of international trade flows perform with respect to what would be a sustainable way of trading.

To this end, we develop a new measure of the distance between realized and sustainable patterns of trade: the Sustainable Globalization Index (SGI). An analysis of this index between 1995 and 2018 reveals that globalization has historically diverged from the patterns implied by Sustainable Globalization until the Great Recession, but is now on a converging trend. This divergence appears to have been driven by three overlapping factors: expanding value chains and intensifying trade in intermediate inputs, Chinaʼs growing role in world trade until 2006, and too intensive trade in agricultural goods and too little trade in energy and mining of raw energy products.

The historical contribution of trade to global emissions

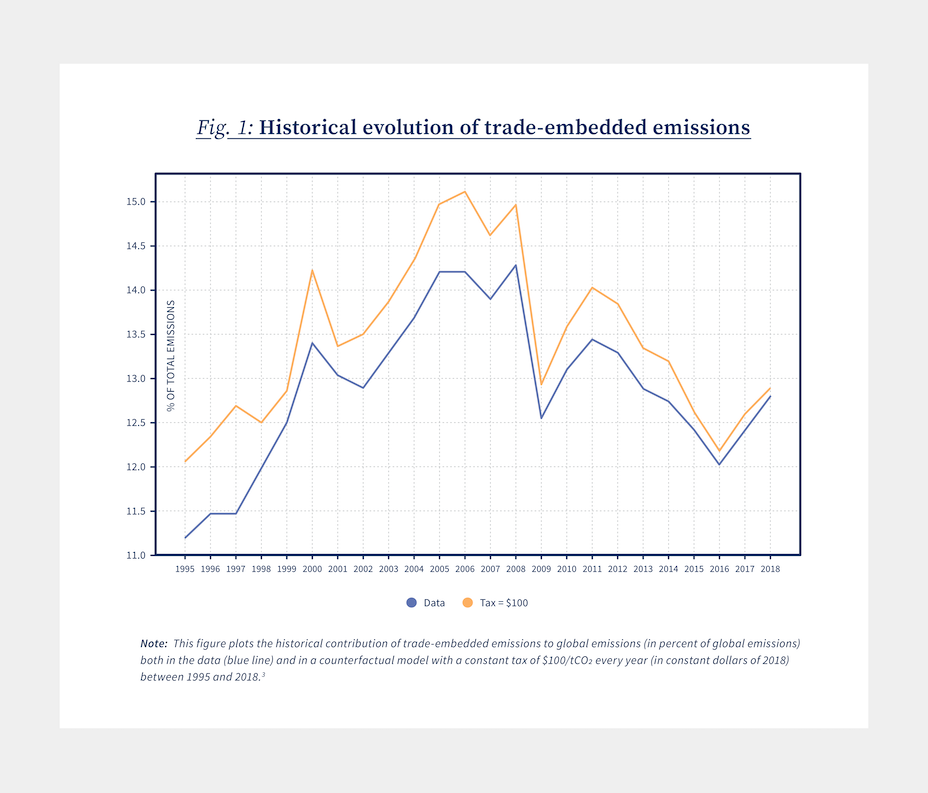

A natural starting point to gauge how sustainable trade is, is to measure the historical contribution of international trade flows to global carbon emissions. Fig. 1 plots the share of total global emissions that have been generated by the production and transport of internationally traded goods and services every year between 1995 and 2018, both in the realized data (blue line) and in the Sustainable Globalization world where carbon is taxed at $100/tCO2.2 There are two clear messages to be derived from this picture.

Trade-embedded emissions have contributed an increasing share of global emissions until the Great Recession

Between 1995 and 2018, trade-embedded emissions have contributed an average of 12.9% to global emissions. This contribution however, has not been monotonic. Focusing first on the share of trade-embedded emissions from the historical data, we see that international trade contributed between 11% and 14,3% of global emissions over the years. There are two clear phases in this evolution. First, a “globalization phase” between 1995 and 2008 characterized historically by the entry of China to the WTO in 2001 and the successive expansions of the EU.

This period corresponds to an increase in the contribution of trade to global emissions from 11.2% in 1995 to 14.3% in 2008. Second, a “deceleration phase” post-Great Recession characterized by a stagnation of the global trade-to-GDP ratio and a decline in trade-embedded emissions back to 12.8% of global emissions in 2018. Note that in this second period, trade-embedded emissions have declined, whereas trade volumes have rather stagnated than declined, suggesting a role for either (i) a change in the historical composition of trade, or (ii) technological innovation in favor of greener technologies.

Trade-embedded emissions have contributed an increasing share of global emissions until the Great Recession

Historically, Sustainable Globalizationʼs trade-embedded emissions should have been larger

Focusing second on the share of trade-embedded emissions implied by our model with a $100/tCO2 carbon tax, we can immediately see that counterfactual emissions closely track baseline emissions but are higher on the y-axis. On average, trade-embedded emissions should have represented 13.4% of global emissions (as opposed to 12.9%). This perhaps counterintuitive result is in line with the observation that more trade is needed in a Sustainable Globalization scenario: exploiting countriesʼ green comparative advantage by sourcing goods and materials from their greenest origins induces an increase in the share of output effectively traded and hence a larger contribution of trade to global emissions. Recall moreover, that this green sourcing effect accounts for 36% of the 27.5% reduction in global carbon emissions in a world with a $100/tCO2 carbon tax.

This counterintuitive result reveals the difficulty of accurately measuring and illustrating how a different allocation of international trade flows could contribute to a more sustainable globalization.

The Sustainable Globalization Index: an alternative measure of the environmental impact of trade

As a first pass, one can measure how much of the total reduction of global emissions brought about by the carbon tax comes from changes in the pattern of trade. We can measure for each year the share of emission reductions obtained solely from changes in trade flows relative to the decline in emissions from the global change in gross output. By going from a world with no carbon price to a world with a cost of $100/tCO2, the reorganization of trade patterns would contribute on average for 11.7% of the decline in emissions achieved by the carbon tax between 1995 and 2018.

An important caveat of this contribution measure, however, is that it essentially reflects the scale effect that we introduced in our companion Kühne Impact Series: keeping sectoral and geographical allocations fixed, a carbon tax leads to a decline in quantities consumed, produced, and therefore traded. As a result, the reduction of emissions coming from trade adjustments corresponds mostly to how much trade is needed in the simulated Sustainable Globalization scenario relative to the data.

The Sustainable Globalization Index: a measure of trade allocation independent of scale effects

In order to truly capture the role of reallocation next of any scale effect, we propose a new index of trade sustainability that we label the “Sustainable Globalization Index” (SGI). Its purpose is to measure how “aligned” current trade patterns are to an organization of trade under carbon pricing at its social cost. It takes the value 1 if current and simulated patterns of trade are perfectly aligned and decreases towards 0 otherwise. Importantly, it does not depend on volumes at all, meaning that if current trade flows were scaled by a constant factor, the distance of the current organization to the “Sustainable Globalization” would not change. As such, it can be thought of as a complementary tool to measure trade patternsʼ contribution to global emissions to a simple measure of emission reductions. It has no unit (as it is an index) and can therefore only be considered in a historical perspective (as any other index).4

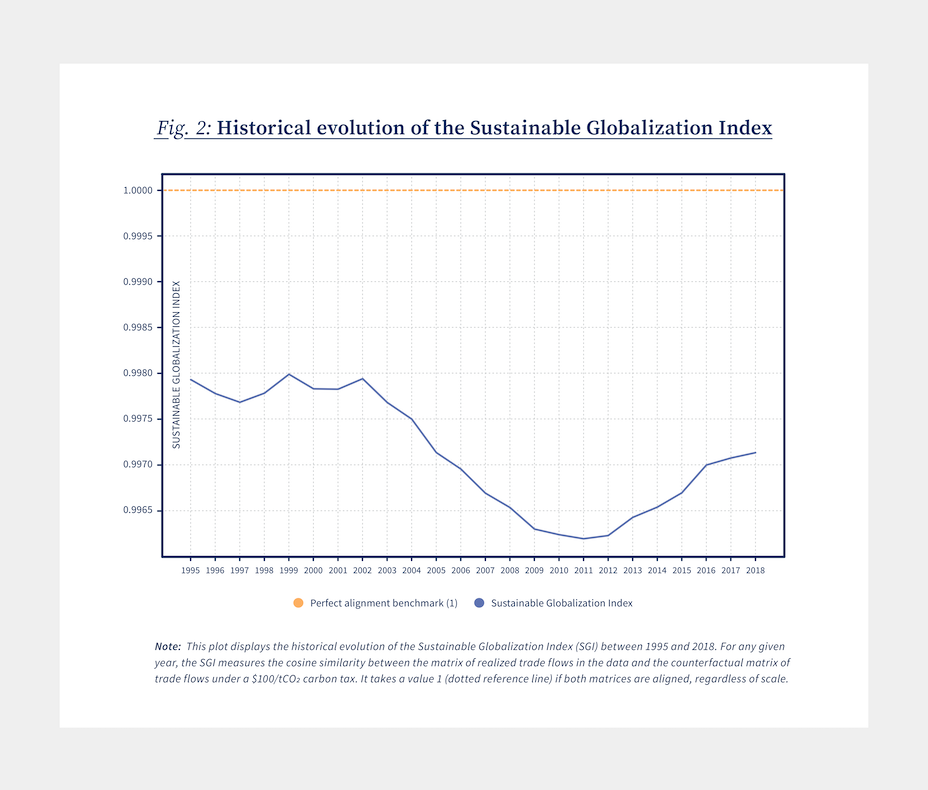

Historically, trade organization was the furthest from Sustainable Globalization in the 2000s

Fig. 2 shows how the SGI has evolved between 1995 and 2018. We can distinguish three phases: (i) between 1995 and 2002, characterized by a constant distance between realized and sustainable patterns of trade, (ii) between 2002 and 2011, marked by a rapid and significant divergence of the historical trade pattern and the counterfactual one implied by a $100/tCO2 carbon tax, and (iii) a renewed convergence phase after 2011. Recall that a higher index means a closer proximity of realized trade patterns to the sustainable globalization at a given point in time.

To understand the historical evolution of the SGI, a first approach consists of differentiating trade in intermediate inputs – which reflects the impact of value chains on our performance against Sustainable Globalization – and trade in final consumption goods – which illustrates the role of individualsʼ consumption choices.

Historically, trade organization was the furthest from Sustainable Globalization in the 2000s

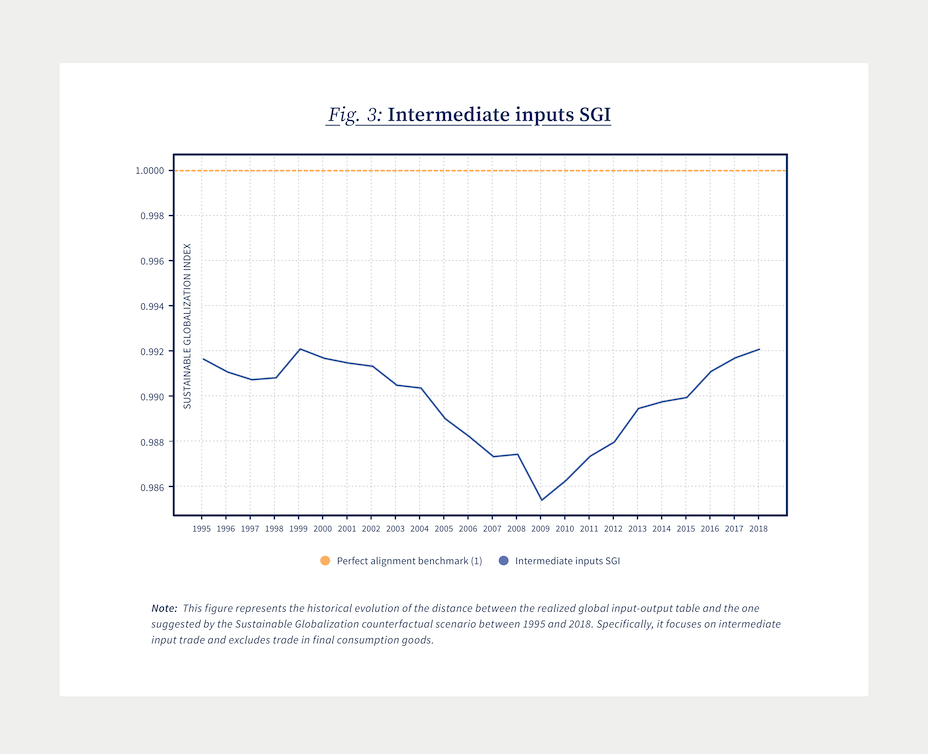

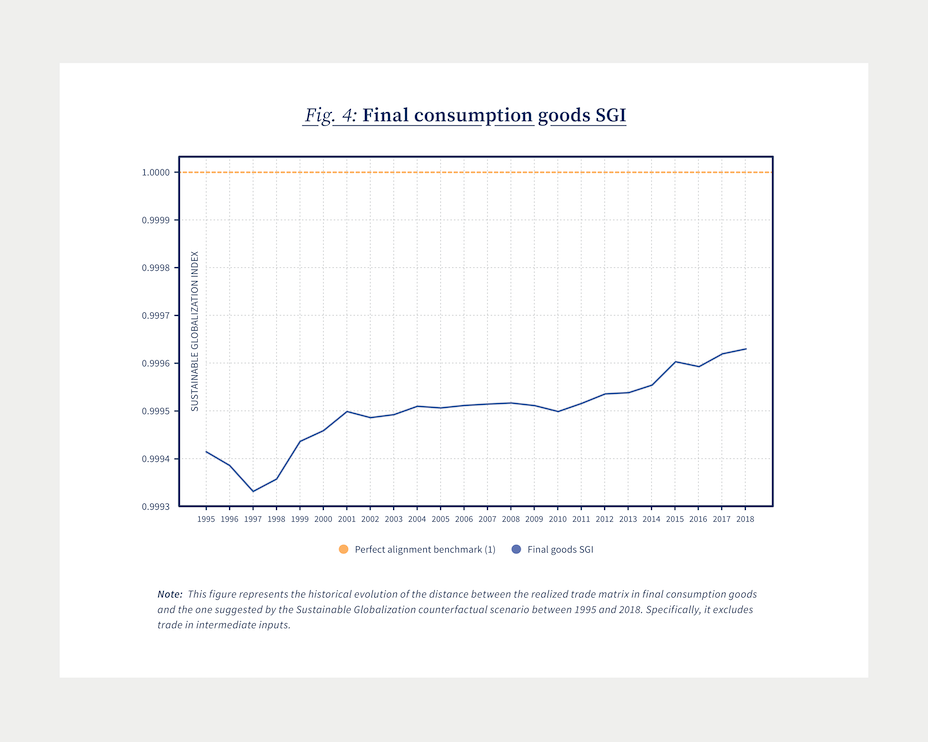

The historical divergence of the SGI has been driven by trade in intermediate goods rather than trade in final consumption goods

Fig. 3 represents the SGI calculated solely based on trade flows of intermediate goods. In other words, fig. 3 depicts the role of expanding value chains and the international organization of productions over the past 20 years on the performance of realized trade against the Sustainable Globalization scenario. Conversely fig. 4 represents the SGI calculated solely based on trade in final consumption goods. In other words, fig. 4 depicts the role of our consumption patterns, as individuals, on the performance of international trade flows against the Sustainable Globalization ideal.

The historical evolution of the SGI for trade in intermediate inputs is characterized by a steep divergence between realized trade flows and the Sustainable Globalization ones between 1999 and 2009, and an even steeper convergence after 2009, bringing the SGI of 2018 back to the level of the SGI of 1999. Interestingly, the period between 1995 and 2009 is often described in the literature as one of intensifying globalization and of expanding global value chains. Fig. 3 suggests that this phase of increasing trade in intermediate inputs corresponds to a strong divergence of realized trade flows to what would have been sustainable. The Great Recession has often been identified as a structural break marking the beginning of a de-globalization or at least “slowbalization.”5

The historical divergence of the SGI has been driven by trade in intermediate goods rather than trade in final consumption goods

Fig. 3 suggests that such a slowdown in intermediates trade intensification may have driven the subsequent convergence of the SGI.

Conversely, fig. 4 reveals that the historical evolution of the SGI for trade in final consumption goods is an ever-converging trend from 1997 on. In other words, individualsʼ consumption patterns have been increasingly closer to sustainable ones over time.

These two pictures compel us to be nuanced in our conclusions. While it appears that expanding value chains have contributed to the divergence of realized trade away from Sustainable Globalization, the evolution of the SGI for trade in final consumption goods reveals that being able to consume “globalized goods” is a key element of convergence towards sustainable trade.

To be able to be more precise as to what in what we trade and with whom may further explain our historical divergence from Sustainable Globalization, we now turn to what characterizes trade flows fundamentally: a product, an origin, and a destination.

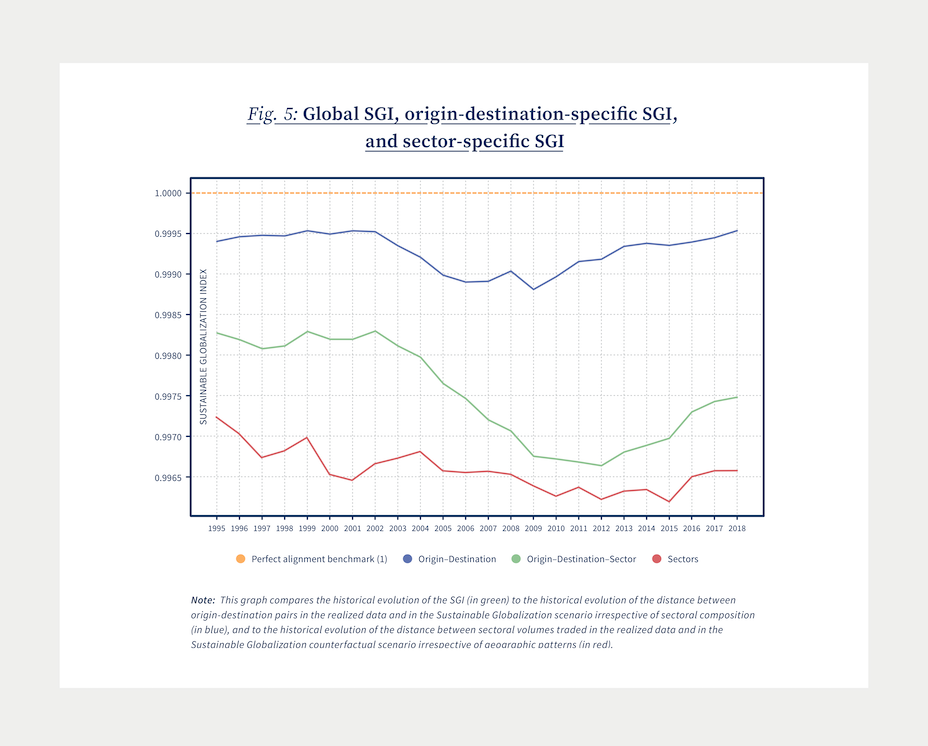

Two main factors may drive the index in that regard: (i) the geographic direction of trade flows (country pairs), and (ii) the sectoral composition of trade flows (and its divergence from the sustainable allocation of production across sectors). Both are represented relative to the overall SGI in fig. 5, in the form of focused indices. Note that these are reminiscent of the green sourcing effect (origin-destination-specific) and of the composition effect (sector-specific) introduced in our previous Kühne Impact Series.

Chinaʼs integration into international trade played a substantial role in the divergence from Sustainable Globalization prior to 2006

Focusing first on the geographic distribution of trade flows, a measure of the distance between realized and counterfactual origin-destination trading pairs (aggregating all sectors, and considering intermediate inputs and final goods together) reveals that the year 2002 marks a structural break in an otherwise upward (converging) trend. From an international trade perspective, 2001 is an important year as it marks the entry of China in the WTO and the beginning of its growing influence as a major exporter. Quantitatively, the model implies a strong divergence between the allocation of trade flows between country pairs in the data and in the counterfactual scenario from 2002 to 2006, which coincides with the largest declines in Chinaʼs trade volumes in the taxed model relative to the data. After 2006, the data suggests that the emission intensity of production in China has in fact been consistently improving, so that the penalty imposed by the carbon tax on Chinaʼs trade reduces afterwards.

Trade in agricultural goods, energy and mining of raw energy products has pushed the divergence from Sustainable Globalization until 2015

Turning to the analysis of the sectoral composition of international trade, we find that the sectoral composition of trade patterns has been constantly deteriorating (i.e., diverging from the sustainable ones) between 1995 and 2015. The analysis identifies very clearly three sectors that drive the deterioration of the sectoral SGI over time. First, the sector of agriculture, which was too intensively traded in the 1990s. The reorganization of agricultural trade flows post 2000 has contributed to the convergence towards Sustainable Globalization. Second, the sector of mining of raw energy products (crude oil), whose trade intensity has been increasingly diverging from what would be desirable before stabilizing in 2005 (however without further convergence afterwards). And third, the sector of energy (electricity and gas), which has been traded relatively too little over time.

Taken together, these two components explain why the overall Sustainable Globalization Index is at its lowest in 2012 (in between the trough of its two components) and on a converging trend afterwards. The conclusions drawn in terms of geography and sectoral composition of trade also align with our companion Impact Series on the necessity to embrace a better way of doing trade.

The (green) future of international trade and logistics

As the SGI suggests a slow convergence toward Sustainable Globalization, we conclude this Impact Series with a brief overview of what is still a source of divergence between realized and sustainable trade at the end of our data period (2018), and some remarks about the (green) future of international trade and logistics.

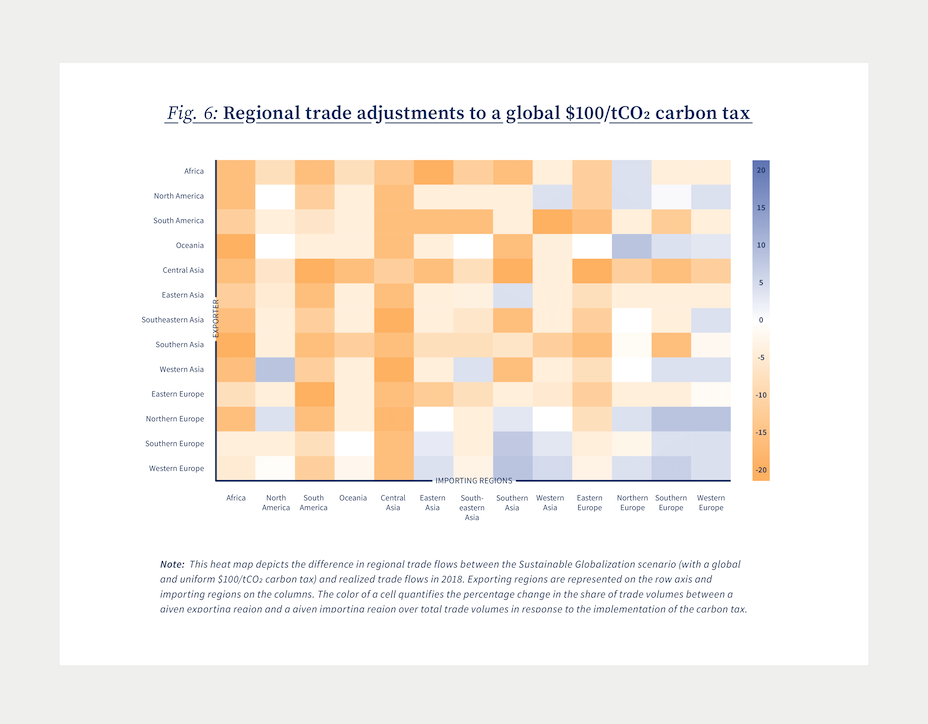

A sustainable globalization would shift international trade towards the West

Fig. 6 depicts the difference between realized and sustainable trade flows across regions for the year 2018. By change, we here mean the percentage gap between region pairs trade shares in the Sustainable Globalization scenario relative to the realized data. The colors are therefore indicative of how we can expect trade flows to evolve in response to stronger global climate action in a near future.

A sustainable globalization would shift international trade towards the West

The general trends suggested by fig. 6 are a decline of trade flows within the Southeast (Africa, Asia with the exception of the Middle East and South America), and an increase of trade flows within the Northwest (and in particular Europe). A few individual regions stand out of the picture: trade flows to and from Africa and Central Asia are to decline substantially, as indicated by their darker color (on average, exports from Central Asia would decline by 11% and imports to Central Asia by 13%), whereas trades from and to Europe (and in particular Western Europe) would remain at their current level.6

Note that these results also suggest that a global carbon tax would further encourage an increase in intra-regional trade. This is in line with the historical convergence of the SGI we have been observing since the Great Recession, in a period of observed stagnation (if not contraction) of global value chains.

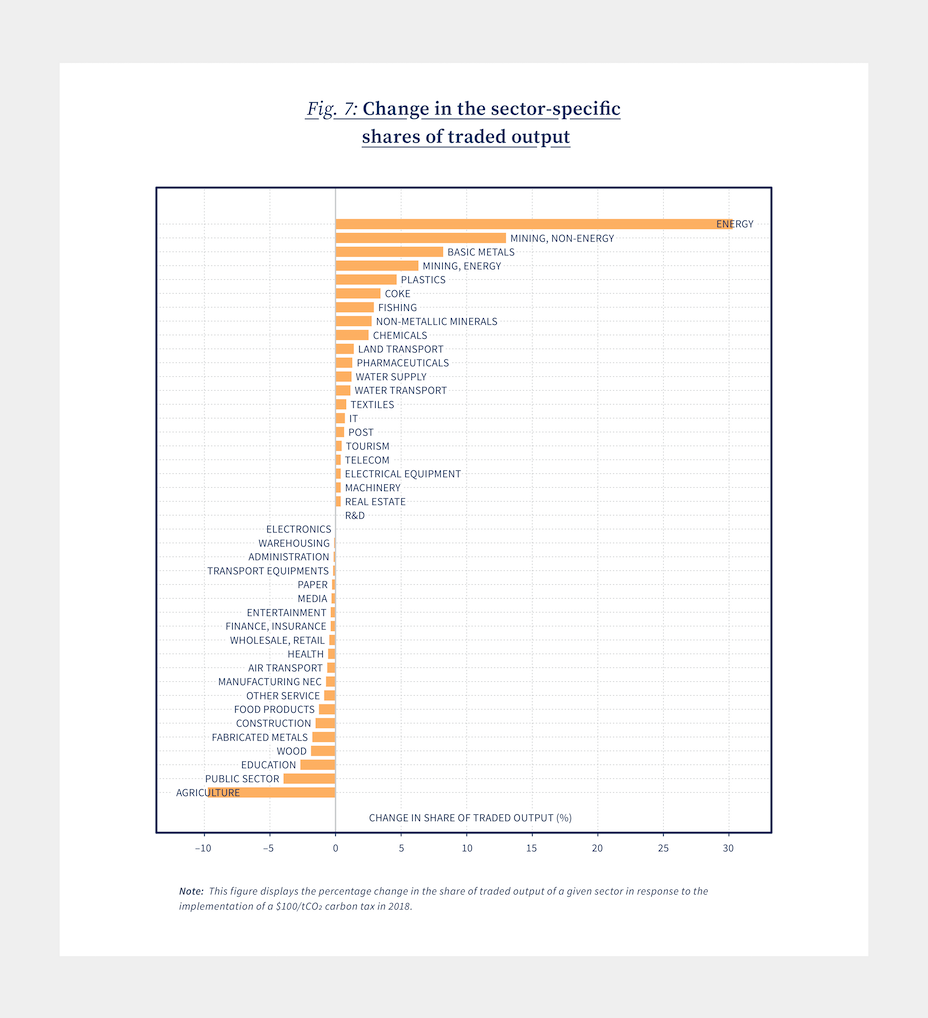

Sustainable Globalization implies a shift of trade flows in favor of energy and raw materials and away from agricultural goods

Turning to the sectoral composition of trade, fig. 7 depicts what could be expected in terms of sectoral trade if climate action further strengthens in the near future.

The importance of the green sourcing effect that we describe in detail in our companion Kühne Impact Series cannot be understated here: the green future of globalization is a globalization where trade in brown sectors should intensify (despite overall output in these sectors declining) to allow for a better and greener sourcing of such products where possible. This is the case in particular for energy (electricity and gas, whose share of traded output needs to increase by 30% in response to a $100/tCO2 carbon tax) and raw materials (that need to be better sourced from countries tapping into the green comparative advantage provided by their natural resources, such as Chile specializing in copper exports). Conversely, trade intensity should decline for services – that tend to be particularly green anywhere and warrant no green comparative advantage – and brown sectors that cannot be green sourced. In that regard, agriculture really stands out as the one brown sector that should be produced and consumed locally rather than (green) sourced abroad, as the figure suggests a 10% decline in the share of traded agricultural output in response to the carbon tax.

More generally, there is a positive correlation between how heterogeneously green countries are at producing a good and how intensively that sector ought to be traded in the Sustainable Globalization scenario. In other words, sectors that need to be traded more intensively in the near (green) future are sectors that can and need to be better sourced, whereas other sectors should be consumed more locally, an effect already emphasized in a previous Kühne Impact Series.7

While climate action in the form of a global and uniform carbon tax is not necessarily on the table for the foreseeable future, strengthening climate action in the form of carbon exchange trading schemes in the largest economies globally can already be observed. As such, our hope is that this read on the historical convergence of realized trade towards a sustainable globalization where green sourcing is at the core of all international exchanges can be inspiring for policy-makers and private businesses alike in embracing trade as a tool to fight climate change.

Sustainable Globalization implies a shift of trade flows in favor of energy and raw materials and away from agricultural goods

Conclusion

In this Kühne Impact Series, we define Sustainable Globalization as the pattern of production and trade that would prevail in a world where carbon emissions are globally and uniformly taxed at $100/tCO2. We introduced the Sustainable Globalization Index to measure the historical divergence between the realized allocation of trade flows and the allocation implied by our Sustainable Globalization scenario.

The intensification of globalization in the 2000s is characterized by an increasing divergence between realized trade flows and sustainable patterns of trade. This divergence appears to be driven by three overlapping factors: expanding value chains and intensifying trade in intermediate inputs, Chinaʼs growing role in world trade until 2006, and too intensive trade in agricultural good and too little trade in energy and mining of raw energy products.

A comparison between realized and sustainable trade in the recent periods suggests precisely that the (green) future of trade and logistics is more trade from and to richer and greener regions of the global North, more intra-regional trade, and a shift of trade flows in favor of energy and raw materials and away from agricultural goods.

- The Green Comparative Advantage: Fighting Climate Change through Trade. Kühne Impact Series (01/2023)

- To be accurate, counterfactual emissions are calculated as the product of the counterfactual volumes produced (or traded) and the country’s sector-specific emission intensities measured in the data. Implicitly, this assumes no potential technological adjustment to the carbon tax, a caveat of the model discussed in more details in the companion Kühne Impact Series.

- Note that our historical data are measured in current dollars every year. A $100/tCO2 carbon tax in 1995 therefore represents a different (higher) price correction than in 2018. In order to represent quantitatively similar price corrections, we adjust the carbon tax every year by the U.S. inflation. As a result, the effective carbon price in 1995 for example is $60/tCO2.

- Mathematically, this index corresponds each year to the cosine similarity between the matrix of trade flows in the realized data and the matrix of trade flows in the counterfactual scenario with a global and uniform $100/tCO2 carbon tax. The main caveat of the resulting measure is that the lack of unit also implies a lack of explicit meaning behind the indexʼs distance to 1. As such, it can only be used relative to itself at different points in time.

- See our Kühne Impact Series (03/2022): Global Trade: A future in doubt? on this characterization of historical trade flows.

- Such trade patterns are bound to generate strong socio-economic inequalities between countries, an implication of our model that we study in detail in our Kühne Impact Series (02/2023): The Distributional Effects of Carbon Pricing: A Global View of Common but Differentiated Responsibilities.

- See our Kühne Impact Series The Hidden Green Sourcing Potential of European Trade (01/2022) to correlate this fact with the role of transport emissions. Agriculture is a strong outlier in our model, as we capture more comprehensively direct emissions from agricultural activities than in other data sources.

About the Series

The Kühne Center aims to establish itself as a thought leader on issues surrounding economic globalization – by conducting relevant research and making its insights available to a broad audience. The Kühne Center Impact Series highlights research-based insights that help to evaluate the current world trading system and to identify what works and what needs to be improved to achieve a truly sustainable globalization.

Author

Simon Lepot

Senior Research Fellow at the Kühne Center for Sustainable Trade and Logistics at the University of Zurich

More Issues

Variable Carbon Pricing and the Environmental Gains from Trade

Optimal Carbon Tax for Maritime Shipping?

The Global Diffusion of Clean Technology

The Distributional Effects of Carbon Pricing:

The Green Comparative Advantage:

Global Trade

The EU Emissions Trading System

The Hidden Green Sourcing Potential in European Trade

The European Green Deal

Post-COVID19 resilience

Africa’s Trade Potential

Buy Green not Local

A New Hope for the WTO?

Crumbling Economy, Booming Trade

Pandemic and Trade

The Dynamics of Global Trade in Times of Corona

EU Trade Agreements

Past, present, and future developments